Hello, and welcome to separate bathrooms. We would like to acknowledge the Gadgo people of the Eora Nation, the traditional custodians of this land, and pay our respects to the elders, both past and present.

Hello. From wherever you're listening this from. I'm Ali Daddo.

I'm cam Dada. Wherever you're listening this from. There's a two in there, isn't there? I know, not being picky, I just say that again.

I know it's okay. I love that you said it, and it's so good.

I just should be in radio. I mean, I just think my language is amazing.

Yeah, you present ideas really well.

You're my grammar. I make up work.

Yeah, I mean that's the thing.

You listen to separate bathrooms, and you can learn more about the English language.

Can learn more punctual, how to speak.

Learn learn to be more punctional. You get some electrocution lessons to speak more punctional.

Exactly.

I love that today we're going to be learning to speak more punctional about money?

Correct, money? Money? Why did I just suddenly lean into a Donald Trump thing? It's weird because he's all.

About the money, isn't He's a transactional fellow. Anyway, enough about that, we've certainly had our ups and downs with money. Honey brings up some emotions for me.

I know, yeah, I know, you're still PTSD on money.

I am a bit, Yeah, I'm a bit, but that's okay.

Well, you know, I've had forty years in the entertainment business.

Contracts sometimes come and sometimes go. We've got to be okay with it.

Look, it is a safe bet to say that most of us want to not only have more money, but we want to be better at using the money that we are getting.

Correct.

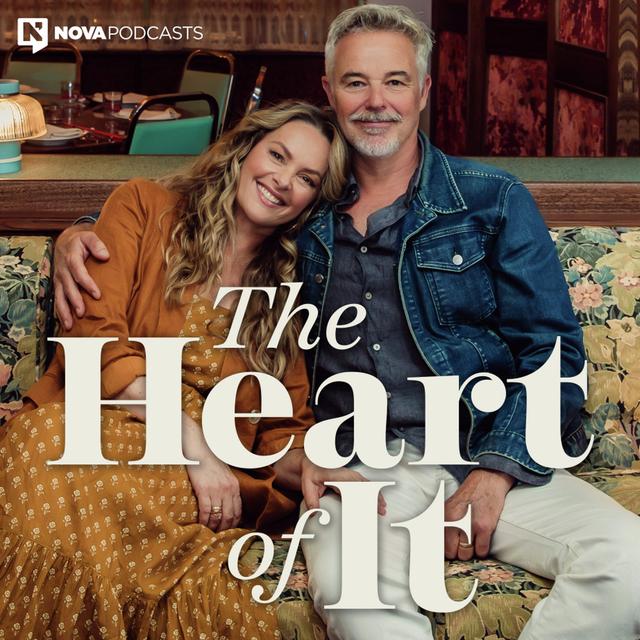

Well, we have Tash and James Millard on the podcast day and they've got a mission to help us and to help you together.

They've created and operate a financial planning company. It's called Sufficient Funds.

And James actually has a book out, but it's called Insufficient Funds Making the right money Decisions to bring your big plans to life. Now.

The way they've written insufficient though, they've got like the im sort of faded into the background, and then the sufficient part of that word is in bold, so it's sort of like you go from insufficient to sufficient funds.

That's why, that's why it's subliminal suggestion.

It's interesting because that word insufficient funds talk about PTSD because how many times in the past have we stood in the line at so many times as the market and you pay for your food and your groceries and then insufficient funds come down.

Only the groceries there and go come back.

Ye'd be right back to get this stuff. Yep.

So the book is it's about to plan your future and find financial freedom and define what sufficient means to you.

And it's not just about settling for less.

I like that, it's get a definition. Yeah, So because often we have these terms used. We use the terms they're delivered on us, but people have different definitions for what they are. So it's good to get clear on that. All right, we're hoping to get the inside scoop and maybe a little more. Welcome Tash and James Millard, you too, Tash and James. Welcome to separate bathrooms.

Thank you, Thank you very much.

Before we get into the subject of money and how it makes most of us cuckoo, this is a relationship podcast. Now you guys work together, you're in money. We'll get to that a bit later. As I said, how did you two meet as he finally gets to it.

I love this one. What did you start with that?

Tash?

Sure? So we actually met at UNI so interestingly enough, James was studying the same thing as me, which was science, so it wasn't finance back then. And we actually met out at a nightclub.

We met at a nightclub called Surf City Old School, unfortunately is no longer.

Where was that Newcastle?

Did you?

Says new Castle?

Yeah?

Was that in the last millennium or this millennium?

It was right on the edge.

So you met at a nightclub, which is kind of great, Allie and I met at a nightclub.

Too, we did. It was pre organized, but it wasn't a nightclub.

That's where.

Correct and not about us?

Was it love at first sight? What happened?

Oh gosh, we were pretty young, so I'm not sure if I'm not sure?

Yeah?

And how long were you? Were you dating a while before you pop the question? Did you?

Yeah? I think we were about eight years Yeah.

Oh, you gave it a good long shot, yeap.

You weren't quite sure for a bit or you just wanted to stretch it out, probably.

More stretching we were, Yeah, we we were early days at UNI. So there was Yeah, I don't know, it was a it was a good time.

So by the time you guys married, were you then, because you went into finance first, didn't you, James?

Yeah, so I I kind of I started at Union Science and was then into commerce. I rolled into a very boring corporate money job in Brisbane for a couple of years and went from there. So yeah, I was kind of right into the money world. Yeah, Tasha's story is probably a little bit different.

Yeah, So we even though we started the business together six years ago, I was still I was actually on maternity leave at the time when we started, and then I went back into my corporate role, which was in medical research, so I was doing that for a while still until two years ago I jumped into the business.

And tell us about though, that first moment of deciding to go start your own business, like what was going on for you at the time and in the world as well far.

Out So, I mean we were Tash was Tasha was pregnant with our second child at the time, and we were living in Sydney in the wonderful Queenscliff and gorgeous. Kind of dropped into a mortgage that was really extending ourselves a couple of years earlier, and then made the call.

I started a business with two others and that wasn't really going where we thought it would, so we made this split and then Hash and I started Sufficient Funds together at the start of July twenty eighteen, which and Eden was born in August twenty eighteen, so our two babies were well two of them, business and Eden all at the same time. And yeah, that was that was an incredibly rocky start.

He was born premier, so it was a lot of time in hospital, right, Yeah, we kind of had to drop everything at that point in time, didn't we.

Yeah, what was it a month in hospital before he was born, and then a month after in and out a bit more after that, So yeah, we had like that was a I mean, we got a lot out of that. That was probably one of those lessons very early on in business especially, but in life it just you sometimes you just got to drop everything in perspective, just takes over. You kind of have no choice.

Yeah, absolutely, tell us about the business because you are a finance business basically, but tell us a bit more about it because the way you sort of approach money and your clients is a little bit different, and I actually really loved how you approach that.

Yeah. So, I mean the focus is always for me, and kind of where I've lean in terms of the money stuff is that that side of things isn't very approachable, as most of the world will agree, I'm sure, and so we lean pretty heavily towards life and then life being let's get really clear on all of that, so that then you can allow your money plan just to facilitate that. And money really is an enabler and that's it. So don't get stuck and caught up in it and

what you're doing and how you're doing it. Just make a plan around aligning your decisions to everything you want to do, that you actually value, that you really care about, and the money side of things. Once you get that right, it can take care of itself.

Yeah. I love that.

I was sitting next to a guy an aeroplane on an international flight. We were up the front, I was being paid for up the front of the plane. I had no business being out there except that I was there, and he was clearly very wealthy with his dripping in gold and a roll, excellent sort of stuff.

And we're having a chat about nothing.

About two hours into the flight, clup my glasses, Champagne. I leant over to him and I said, what is your definition of money? And he said that's a good question.

And then he looked at me his square in the eye. He goes lube.

And I'm really, he owns a loube business, right, yeah, astro glide or something like that.

Could you imagine my own at Gli.

Valve, you know what I mean? Val Yeah?

He no, he said lubricants. And he said it's it's simple as that. He said, you really shouldn't be scared of money. He said, it's just just call more in and I said, it's probably easy for you to say.

I don't remember how the rest of the conversation went, do.

You you you asked him for a million dollars years because you do?

You have some more, mate, You spare a mill.

You've got five hundred of them. You're not going to miss one, just one. Come on, do you have a definition of money?

What is it?

Few?

I don't know if I've got a definition of money.

I mean, it's it just comes back to that. It's just it's there to do all the things you want to do. It's not a like don't don't make it the core. Don't make it the core of what you're trying to do, right, Like this, this idea of money, money is scary, and and you just want to go, where's my life at? And how do I just align it with that? And I mean, we can unpack if

you want to to how to do that. And that's kind of what we attacked in the book is some really critical steps in just getting clear on what you want to do and then bring it together.

So it's really okay, so that's it.

Then have an idea about what it is you want to do, and then and then take action based on that rather than like, shit, we just got to make money, and the stress all around that.

As advisors where we're constantly approached by people who come thinking, well, they're money people, we better tell them our money problems or our money goals, right, And that's critical and it's all part of it. But if you go to an advisor and they say to you, what are your goals, you're going to straight away naturally say well, I want to reduce tax or save more or invest or deal with this lump some of just got inheritance or whatever it might be. And if you lead with money, you

skip over the important stuff. You dive straight into trying to fix, into solutions mode, trying to fix those money problems. All of a sudden, life takes over and everything else changes and the plan. At worst, the plan can completely fall apart because you're investing, but you forgot why. And so if you can come back to get clear on the stuff up front that actually matters, list your values, out list your goals, think about milestones that are coming up,

all of that sort of thing. We call this define and it's the first step. It's the missing step really for how to attack your money plan.

And it can be so much more scary when you look at it from a financial perspective or this financial jargon. If you look at it from life. Everyone's got life goals. Everyone understands what they want to do next, what they would like to achieve in the next five to ten years. Yeah, yeah, just makes it easy.

Tash, have you seen some really great success stories from the advice that your company give to people.

I think we see and you know, I'm not personally a financial advisor, but through the business, we see people achieving their goals every day. So that's something that I think we're very lucky to see that. We see we definitely see people come to us that aren't in the best spot, but we also see the amazing work that

comes through every day. If I can think of, you know, people that have been left with unfortunately large inheritances, I can think of her client who was widowed and she had to really figure out where to go from there, and to see her move on from that from a you know, a life goals perspective, but then also get her money sorted and feel confident getting your feed back under it was really that something that stayed with me.

It's interesting you say that because you said unfortunate and a large sum of money, you know, in the same sentence, and that's not normally well, I wouldn't have thought that would be an unfortunate event.

But under the circumstances.

As a widower.

Yeah yeah, campslow dollar signs.

Are got excited about someone's life being someone.

Maybe that's it. Maybe that's what I just go A big chunk of money. My god, it's so driven by money. It's terrible.

Not actually driven by money.

I wish we had more.

Yeah, yeah, yeah, you need to come and work with us.

Can we do? That's the thing.

And now we've been reading your books well and I'm like, this is really good.

Yeah, j Allie says to me when we were when we were preparing to meet you guys, She's like, I think we need to work with these two and I'm like really, She goes, yeah, I think so. So well, let's just have a chat to get to know them first.

Well, so far Ali's Alie's good, which she's met that she's met the criteria. We'll work on you.

Okay, yeah, you can work on me. I guess where I was going with that question though, Tash was.

I hear a lot about people who win the lottery and that's a good news thing and then two years their life is in the ship. Yeah right, because I'm guessing in America, if you win the lottery, that actually make you I think, well, I can't make you do anything because you're Fifth Amendment or whatever amendment it is, but they actually have you go through some kind of a money course on how to manage this massive, you know, win fall that you've experienced.

Is that a common thing?

Do you think winning the lottery?

I'm not sure.

Definitely is more common than not, but large summer money and not knowing how to deal with it at.

The moment, we are about to see the biggest lot of inheritance come through from the from the elder generations through the younger generations, this intergenerational wealth transfer, and we're one of the things that we advocate for is having those conversations up up front early before people pass away and then you're left with figuring it out at the end. Why not see the benefits of passing that money onto your offspring a bit earlier.

So, yeah, it's always that crazy time with someone coming to us, and it's often and because we work with a lot of people under fifty and sometimes they're in their kind of mid to late twenties with this lump lump sum like we're talking about. They didn't want it, they wish it was different, but now it's there and they feel this incredible responsibility to steward it well. And sure, you know, but sometimes, I mean, what we've been as Tash was alluding to there, is having these conversations with

people earlier and getting it on the table. So if you've got an estate plan in place, tell your kids, tell your family, tell them who's getting what it looks like, so they can get their heads around it and if they've got a problem, bring it up now and we can talk about it. So, yeah, it's a very it can be a very touchy subject. I mean money is it's so taboo for everyone or so many Yeah, and you know, unfortunately that means it doesn't get talked about until it's too late.

Sometimes do you have couples come in and they're at odds with each other.

So not necessarily at odds with each other. We have so about seventy five percent of our clients are female, and it's mostly the females that are coming. Even when it's a couple, it's generally speaking the female that's leading that conversation. So sometimes we can see people with mal aligned goals or you know, not necessarily you know, someone might be on board and the other one's not. But

generally that's kind of part of what we do. Unpack those goals up front and make sure that everyone's on the same page, because that's important. When you're a couple and you've got money that you're sharing, it's really important to get that right. And it's okay to have you know, the separate bank accounts. So that's a question we get off and is it okay to have a separate bank account.

You can run off with your money or whatever. It's okay to do that, but it's the conversation upfront to have if you want the combined bank accounts or if you want the separate bank accounts or a mix of both.

Yeah.

Interesting.

Cam encouraged me to get a separate bank account.

Not that long ago.

We've been together thirty two years and it's probably about a year ago.

Yeah, so we've been together for over thirty years and we just had a joint bank account.

Every Yeah.

She was saying, honey, you're making your own money. You really should be putting money away for yourself. And that was more about from the example of my mom, because she's always had her own little stash, you know, and she'll give her grandkids a present, or she'd be up selling her pottery and she'd put her money in her own bank account, you know. So I thought it was important that you had it.

Is it? Are you glad you have that?

Oh?

Yeah?

And there was an I remember we had many many episodes ago there she's.

Got more money than God. By the true so I have no access to it.

Think no, But I remember this female money advisor who talked about that, because I don't know if you've come across this as well, Tash and James, that a lot of women often don't have their own account and there's such an empowerment in that. And I feel so empowered by having my own bank account. I absolutely love it and that's good.

I really like.

It feels so good to me and I love watching it grow. And I love to be able to go Let me treat you, Cam, It's my treat, you know what I mean. I just love to be able to do that. And yeah, same buying stuff with the kids, or I mean, my trip to Tahiti's coming up on my.

Own and I just can't wait.

To go on that.

How ridiculous is it that we're actually having this discussion though, right?

I mean, the equity between partners should should be there, and you know it's not necessarily in so many cases we had, I mean, one part that we like we added into the book and put a kind of a fairly big section on it was this idea the gender pay gap and gender super gap that then comes as a result, and that's not necessarily driven by anything other than the systemic issues around the government and how we support people when they start a family, especially, and things

like superbalances starting off similarly, and yeah, the wage balance might be off, and if that's the case, then they stop work and it might be the female is having the child and spending more time off and returning to part time and that's all generally, that's a natural occurrence for so many, but it lends itself to them getting closer to retirement with a superbalance that's way off in terms of partners. And I mean, there's all sorts of things.

I actually delivered a plan to a clients yesterday and we talked through he was actually going to split twenty five percent of his contributions into her account. And you can do that if you meet all the criteria. So there are options to kind of do things like that.

So even if you do see yourself together forever, which most people would say, yeah, that's the case for us, it's sometimes it's not going to be the case, right, And so having a bit more stability, even just in the numbers like that, even with that very boring topic of super can actually change someone's complete like outlook on it all.

Is there something as basic that you could give us as three top financial tips?

Is that really hard to do?

No? No, And you know we try and make everything really relaxed and relatable, so absolutely we can. We can do that. So Number one, we definitely advocate for just knowing where your money is going, so ins and outs of your money, opening up your bank account and just seeing where is your money and the number of people that just don't do this or don't have a good rhythm around doing it is astounding. So I think that's

just an easy one. You can sit in a waiting room on a train and just open up your bank accounts and just have a scroll through.

Getting on the same page is a really important part. And this comes back to that same that overall kind of discussion around being super clear on what you want to achieve. That's not an individual discussion. That's what that part we call define is get really clear on your goals. And you guys can have joint goals, but you're also going to have individual ones. Yeah are you are you taking Cam to Tahiti?

No?

No, so there you go.

To do that?

Right?

Where are you going?

Probably go? I'm making this up?

No, one's no one's going anywhere, but it does luxury escape.

It's nice at home making spaghetti pollinaise to my younger.

D next year.

Next year, we're going somewhere special together, are we?

Yeah?

Surprised?

Okay, all right, you.

Have a big celebration next year for you job.

That's anyway? All right, go ahead, go ahead?

Yes, Later, getting control, getting control of your money, getting super clear on what you want to achieve, And that's defining it before you start planning for it. And then I mean something we could probably talk all day about and we won't. But defending the section in the book, it's the fourth chapter. It's called defend and it's when it shit hits the fan. And this is, you know, just making sure that couples have a plan for it

going wrong. I mean a lot of people talk about having an emergency fund, but also having that discussion of what happens if we have to use it and how do we bounce back from that? And I mean that shows up in all sorts of ways. It depends where you're at. It might be starting a family, like we had the fun of in and around all of that at the same time as the business and the mortgage was huge, or it could be the widow scenario or divorce or whatever else it might be. So you've got

your kind of outs. And I mean, something very boring that we talk about, super critical in terms of financial planning, is that that idea of income protection insurance, having life insurance, having mechanisms in place where if it really goes wrong and you don't fall apart completely financially.

So you do advocate for that for insurances.

Yeah, definitely, And I mean they're like those types of insurances that we're talking to clients about, Like it's not a broken finger, something's really gone wrong.

You see, you're.

Injured, you can't work, and in the money side of things, everything can completely fall apart, and most of the stuff is something you can't, like you're either selling if you've built up some decent assets, you could sell things to get yourself through. But in many cases it's it's just a looking at having a look at that and saying, well, if this happened, where would we be, and could insurance

that make sure it's affordable. Some of it can be paid through super as well, Can that fill the gaps if we need it?

All the tricks of the trade, they're so good.

I also heard too that particularly as the female in the relationship. I'm sure it goes both ways as well, but make sure you know, like whose name is on the account, like I've heard of like when the husband's passed away and it's a it's all in his name and the wife has difficulty getting access.

To the accounts. Is that correct because she hasn't of it?

Yeah, yeah, yeah, And I mean this comes back to that idea of joint accounts for almost everything, right, And I mean if you're a couple and you're trying to work this through, we do a lot of work in that that idea of blending or merging accounts. Often if people are like you, guys, were fully joint right until

you set up your separate account. But a lot of couples that are newer will have everything separate and then they'll join maybe one account for expenses because they're paying the rent or the mortgage together, and then it grows

from there. But often people get stuck then. And I mean, ultimately, the perfect the perfect result for us is often ninety five percent of clients we do the same thing for in terms of couples, and they end up with their personal spinning out each but everything else is joint because most of the time, I mean, you're planning a life together, your goals are all joint in most cases.

Anyway, the book is called Insufficient Funds Make the right money Decisions to bring your big plans to life. How soon after you guys formed your company Sufficient Funds did you decide to write the book.

Well, it's pretty much straight away, wasn't it. We kind of had this micro goal of this will be a little tool that will help educate clients as they come on board. But it kind of it morphed into a much bigger project, didn't it.

Yeah, I did. It morphed into something that I mean now we're super proud of it. But I mean that idea of Insufficient Funds was from way back looking at the ATM slips and even in our UNI days we were selling trucker caps and T shirts to what we thought would be our big brand, the Surf, and that we'd sell to self for sixty million and never work a full time.

That we all think that companies.

Yeah, yeah, and.

That didn't happen and here we are. But we were looking back on that thinking, well, and that's where the name sufficient Funds came from in terms of the business was the flip side of that. It's no longer all time and no money. It's now less time and money. But how the hell do we bring it all together? So the book was insufficient Funds? How do we get to sufficient funds? And then those five kind of main steps to take that everyone can follow to get you there?

Do you both as a couple celebrate financial milestones?

And how do you do it? If you do do that?

So we have in the past, I think we need to do it more. And actually I had a really good We've just started this new idea which I've stolen from someone else, But it's having a bottle of wine. If you've given a really nice bottle of wine and you put a label on it and write your goal on it. So my house, I want to hit this particular salary or whatever it is, and then when you've hit that goal, you enjoy that wine together.

I love that with the person that gave it to you.

Yeah, it's so nice. Yeah, just with you and me?

Yeah yeah yeah.

No.

The reason I said that with the person that gave it to is I when I'm giving a bottle of wine. I will write the person's name, gave me the bottle of wine. And then maybe if they you know, we're still pals to years later and they come over, I'll pull that bottle out and go I remember this, that's had a moment to rest.

And that's always nice sharing that. I like that saying that.

In saying that, we've probably always got bottles in the fridge ready to go, so it doesn't have to be special.

Yeah.

Sure, if there's bubbles ready to go, I mean the smaller milestones will crack something very quickly.

Yeah, it's nice.

It's nice to celebrate even the small ones because it feels like you're moving in the right direction.

Okay, asking for a friend. So, say, if there was a couple that.

Really wanted to buy a house and they basically realized that they are of a certain age and banks don't want to give them much of a loan because they're of a certain age. Now, is there any advice for those couples?

Speaking generally, James.

So, because we're not writing this down or anything.

Most of the time, I mean.

It's like our friends that need help.

So for your friends, there are the bank. Unfortunately, what the bank does is they're looking at, hey, we're going to lend you for a loan. We're going to we're going to put it up for thirty.

Years, I know.

And that's the challenge they're looking at. Okay, well, where are you at that point in time? And will you be working? And what does that maybe look like?

Young at hand, so young at heart, fit and healthy.

Baby, you'll be mighty in thirty one we're still via Island working.

I'll be virile. Can I be working? Bloody?

Dick Van Dyke just got nominated for a Daytime Emmy Award and he's almost one hundred I know, so I can.

Bet you beyond his own house it does.

So go ahead, Jenny's there's.

No there's no cap on running Smooth FM.

Surely exactly.

Yes, they're looking for exit strategies and so you've got to come up with a plan around, well, if we are, if we're ninety and we can't we're not working and we can't afford this. Can we pay out the loan

with superbalances other investment? Is there anything else there that would facilitate all of that to make sure that they don't have to sell the house if you stop working and stop earning, so right, if you can, yeah, if you can, if you can drum up a proper story around that, or if you don't, if you don't have a good mortgage broker, well then you can talk to us or someone else and sort that out.

See.

Also, we are so fortunate guys in that all of our parents are still alive. And so I'm hoping. Although my dad did say to me, because hey Bartie, I'm spending all of your inheritance.

It's good on your dad.

There's also five of you, so get rid of it.

All I said, you just make your last check bounce, have fun, you know, to go for it. And so I guess in that, like when you talked about the transfer of wealth that's coming, of generational wealth that is coming.

I don't know.

I'm not relying on any transformation of wealth from our folks, like I really mean it. I want them to spend their money and have a great time. They absolutely have worked a lifetime to enjoy.

Whatever they want. Yeah, you know. At the same time, Oh my fuck, terrible area.

We're trying to buy hous here.

Do you have any dreams or aspirations for your future?

Oh we're best seller.

So I think for us, it's really that concept of complete freedom. So we're already kind of working towards that. So I think that's putting all our eggs in the one basket with the business is really a step towards that. And then yeah, freedom of time, freedom of location.

Yeah, I mean we started we started sufficient funds remotely and we've got a team of twenty four now and everyone's working from home and so like it kind of we could do it from anywhere, and that was kind of the initial goal. But you still need the money

to support it. And I mean, because I guess what we love is the fact that we probably don't see ourselves selling this an anytime because if we can keep it rolling the way it's going, it's a lot of fun and good and we feel like we're doing good work and we're getting results for clients, and so I mean, ultimately it's it's just it needs to be more profitable and support us to be able to go and do all the fun things we want to do and probably

dial things back at some point. But yeah, complete freedom and more adventure.

So our listener can find you online and can work with you from anywhere. Like you said, you can you can be remotely have meetings on Zoom and things like that.

Yeah, yeah, exactly. Yeah, everything's everything's online excellent.

That's not helpful.

And you guys have got three it's three kids, two kids, two kids?

So are you already?

How old are they?

Seven? And just about to be six on the weekend?

Ah, happy birthday? Just about to be six.

So you they're lucky kids because you will know how to assist them from an early age. I would imagine money wise, because that was something love my parents.

But they had to that like all the things like I.

Owned my own apartment when I was nineteen years old. Now if someone had to said keep the apartment because I had no reason.

To sell it.

If someone had is it, just keep it, we would be in a really good.

Position, very different position.

Like there's so many things that like you look back on, but you guys know that already.

So your kids are going to be super money smart.

We just we just make them negotiate on jobs and have the money if they Yeah, I mean, I guess the skills, it's.

Skills.

I think I think the sales skills is probably more important or as important as the money skills is being able to have conversations with people, and so yeah, we I mean we do it.

We do.

We do the savings, the jars and all of that sorde of things. And we don't like, we try not to reward everything. Because you live in our house, you've got to do some stuff. You got to help out. Yeah, but but yeah, I mean at a line, our daughter will come to us with a bunch of unfolded towers and go, hey, I'll follow these for a dollar.

All right, right, Yeah, she's a good negotiator.

And do you think it's ever too young to learn about sort of the value of savings and you know, understanding that side of things.

I don't think so. I think so many people miss out on even the language just communicating about money. So I think, yeah, it's never too young.

Yeah, great, All right, guys.

The book is Insufficient Funds Make the Right Money Decisions to bring your big plans to life. It's available in all good bookstores.

Yeah, yeah, online as well.

Okay, excellent, And you are at Sufficient Funds dot com dot au.

That's the one.

That's the one. All right.

Before we're going to let you go, we're just going to hop into the shower for two minutes.

We want you to answer these questions. Yeah, money shower.

You might stay in now longer if it's some money, exactly.

So, just we want you to both answer the question with an economy of water.

Please.

What's the most adorable habit you love about each other?

Tash is talking in her sleep.

Oh yeah, nice and all the stories.

Oh gosh, it's really help for me to decide one about you. I think when James gets an idea, he obsesses about it, So I do like to call him obsess so and he'll just yeah, he gets down a path and just runs for it. So it's much. I think it's a double edged.

Sword though I love it.

That sounds like a superpower obsess So is there a favorite moment that you would love to relive with each other?

Yeah? The West Coast. We did a like a winner Bago trip down the west coast of the States. Oh nice, about a decade ago?

Yeah, many kids?

That was fun.

Where we.

So we did a couple of days in Vegas, then we flew up to Seattle and drove from Seattle all the way down. We took the Winner Bago as far as I think we did. We go into Yosemite, we did Smite and then San France dumped it there and got a I think we got a Mustang after that, did.

The Mustang around Napper.

Yeah, what a great trip. Yeah that wash How to beat that? Now you can choose the same.

So the other one I would say is we did a bike trip where we rode a bike. We rode mountain bikes, a cross country mountain biking from Luang Prabang in Lao to Hanoi in Vietnam. And there was a point in that trip we we often say we're having a really hard day or a really hard moment. We say we're fou lowing. We had to climb this hill, this mountain that was just like ridiculous and we were definitely not fit enough for it. But we got to the top and I think nice.

It was six up and it wasn't an electric pace, no, and.

It was like we we booked this group trip and I don't want to really, that guy was going to tour it was the hottest We didn't realize, we didn't do any research. We just booked this group trip and

no one was on it except us. So we got this private tour because because it was the hottest time of year, and it was also the time, so it's forty degrees every day and the guys that they do this thing they call slash and burning, where this one month of the year they just burn all their crops and so we're riding along in forty degrees just making inhaling.

Just to add to the fun, the six k uphill.

Was above the smoke.

Yeah, there you go.

Well, all right, what the world needs now is patience.

I think you want to elaborate.

No, she said, that's good. Patients is good in the water. We're conserving water here.

An ability to bite their tongue when we're going to say something silly, and that as everyone else.

Yeah, okay, yeah, last question. One word to describe each other.

Resilient, determined, Yeah, beautiful, great, beautiful, James and Tash, We've got some friends that we know are going to be calling you.

Yeah, and that is really good.

And I'm sure our listener has had their ears peaked as well, or certainly their wallets or their bank accounts correct.

With what you have to offer. So thanks so much for being with us today.

Thanks Cameron, Ali, thanks a lot, Thanks your time.

Yeah, pleasure their book.

As we were saying before I have started reading it, and it really is a readable finance like I am.

I don't know any of the lingo. I don't know.

I was so little about finance. But yeah, they've just written it in a very easy to read, you know, set out well, great way, and it's I'm really enjoying it.

How often are you reading it? Are you reading it every day? Every day? Or no?

No, just when I when I see it, I'm like ah, because I actually started reading it a lot and then I got life took over for a little bit. But I've picked it up again.

And as alter picking it up, have you made any changes?

No?

Okay, yeah, no.

I'm just ingesting the information.

But what I what I want to do is actually talk to them in person and just see how they can, you know, assist us in reorganizing our life.

Were you talking about us?

No?

No, no, just the friends can go first and they can Oh yeah, then.

We'll go after good thought. Yeah, all right, it's good to know. I'm going to give too much of our personal life away here. Yeah, we can sneak around in the bathroom forever.

Oh my god, all right, we're going to leave you.

Thanks for being with us until soon take care