00:00:00:00 - 00:00:09:10

Warning. The following podcast contains elements relating to child trafficking that some viewers may find upsetting and disturbing. Viewer discretion is advised.

00:00:09:15 - 00:00:36:15

Paul Hutchinson

I'm the founder of over 20 plus companies. The largest one is a $43 billion real estate investment fund. We're the number one performing real estate investment fund of our of our kind. For the first ten years that I was running it, we’re the top at emerging managers worldwide. So these principles that I'm teaching you now, although they were starting out small, I use these same principles when we built huge companies later.

00:00:36:15 - 00:01:01:14

Matt Haycox

The importance of learning how to sell, the importance of learning how to handle rejection, and the importance of always consuming knowledge, which obviously is, I guess, the translation of what you meant by saying that, you know, let's hope you’re car radio doesn’t work - exactly! - university on wheels. I guess listening to audiobooks, you know, consuming knowledge on the move. If you listen no further to this podcast and just take those three things away with you, it is the guaranteed route to success.

00:01:02:00 - 00:01:08:18

Paul Hutchinson

It'll change your life right there

00:01:08:22 - 00:01:27:17

Matt Haycox

Guys, Matt Haycox here. And welcome to another episode of The Matt Haycock Show. And I've got a guest and a theme today that I'm very interested in, and I know you guys are going to be as well, because it's actually something that we've never covered on here before. I mean, I’ve had many, many business owners. Probably most of my podcasts have been with business owners and talked something entrepreneurial, which is what we’re also going to do with this guest.

00:01:27:17 - 00:01:48:17

Matt Haycox

But Paul Hutchinson is also involved in child trafficking. Well, not involved in child trafficking, involved in rescue missions rescuing children from child trafficking. And he's actually, we've just been talking a little bit before we started recording this and he's been undercover for the last ten years. He’s only recently in the last few weeks that he's actually even started talking publicly about this.

00:01:48:18 - 00:02:04:22

Matt Haycox

So I'm super excited to hear the story. Super excited to dig deep. We're going to talk about that. We're going to talk about his entrepreneurial background. We're going to talk about how he mentors people, how he talks to royalty, to billionaires, to audiences all around the world. I'm sure there's plenty I'm going to learn and there's plenty that you guys are definitely going to learn too so Paul,

00:02:05:02 - 00:02:06:02

Matt Haycox

thanks a lot for being here.

00:02:06:03 - 00:02:09:12

Paul Hutchinson

Awesome. Well, thank you for having me on your show. Super grateful Matt

00:02:09:12 - 00:02:28:01

Matt Haycox

I feel like I’ve already got to apologize for the introduction because it's the first time I've introduced anyone as a child trafficker. But it's obviously not what I meant, but we're going to go deep on that soon. And I know that probably comes later in your story. But let's let's just talk about how it all began.

00:02:28:01 - 00:02:31:16

Matt Haycox

What's the beginning of the journey for Paul? How did your entrepreneurial background start?

00:02:31:17 - 00:02:49:23

Paul Hutchinson

Absolutely. Well, I always wanted to be a business owner, but my dad always told me I was- I wasn't qualified for it because I wasn't very good at kissing butt. And he and his company had to start at the bottom and work his way all the way up. And so I was encouraged to go into something else. And so I wanted to go into medicine.

00:02:49:23 - 00:03:18:08

Paul Hutchinson

I wanted to be a doctor. I wanted to be a pediatric cardiologist, not a not a regular doctor, but a surgeon, not a regular surgeon, but a heart surgeon, not a regular heart surgeon, but one that operates on children and helps children. And I got a lot of my college done in high school. I, in college, I, I was about two months away from taking the MCAT and I got in a major car accident and I, I severed the tendons in my hand and they didn't know if I'd have the ability, the dexterity, to be a surgeon.

00:03:18:08 - 00:03:39:23

Paul Hutchinson

And so they told me, Paul, you can you can be a regular doctor. And I said, I said, I don't want to be a regular anything. If I'm going to be a garbage man, I'm going to own the dump. You know, that's just how I think. I got one life to live. I'm gonna live it. And so I had a friend of the family who was pretty successful in businesses as an entrepreneur and gave me some tips.

00:03:39:23 - 00:03:55:22

Paul Hutchinson

He said, Paul, he said, You have a unique gift with people. He said, Why do you want to be a doctor anyway? I said, I'll be honest, I want the money. You know, I'll go to school for 12 years so I can drive a Ferrari someday. And he said he said, you know, you ought to sit down with the doctor and ask him about his lifestyle.

00:03:55:22 - 00:04:09:10

Paul Hutchinson

A surgeon is where you want to be. And I did. I actually took the surgeon that did the work on my hand. I took him to lunch and I asked him, I said, Tell me about your lifestyle. And he said, Well, he says, I got a beautiful home, got nice cars, got a motorhome, part ownership on a plane.

00:04:09:13 - 00:04:28:10

Paul Hutchinson

He said, I've got two teenage kids and I don't even know them. He said, I work 100 hours a week to maintain the lifestyle for my wife and kids and I can't retire because I'm tied to my beeper. And it was- and I realized, wow, that even though he's at that level, if you're trading time for money for things, you do it forever.

00:04:28:10 - 00:04:47:06

Paul Hutchinson

And so I went back to this mentor guy and I said, Matt, tell me- his name was Matt too, ironically. Matt. So and I said, I said, tell me, what are you thinking here? And he said, Paul, he said, if you if you do what I teach you to do, you'll be a millionaire by the time you're 30 and you'll have the time to enjoy it.

00:04:47:10 - 00:05:09:04

Paul Hutchinson

And for me the- the combination of time and money both was way more intriguing than just having a Ferrari right? Having the ability to really enjoy your life was was super valuable. And so I said, okay, what do I do? And he said, Paul, he said, Every good business owner knows how to handle rejection and knows how to sell.

00:05:09:10 - 00:05:28:20

Paul Hutchinson

He said, I suggest that you you find the hardest rejection job you can possibly find. And I’ll mentor you from there. So I did. I found a job at a call center cold calling, selling children's videos and- but I didn't want to ever sell anything I didn't believe it. And I was already dedicating my life wanting to help children and in being a heart surgeon.

00:05:28:20 - 00:05:49:19

Paul Hutchinson

So this one, they were they were selling videos that help kids with stranger danger and honesty. And, you know, just some fun little videos that have helped parents teach kids these these principles. And so I, I. Long story short, I'm not going to go into the details unless we want to on that. But. Well, actually, I will, for entrepreneurs in your program, I think this is super important.

00:05:49:20 - 00:06:07:23

Paul Hutchinson

He told me a few things. He said, Paul, when you're there, you need to work to learn, don't work to earn. He said, If you're there for a paycheck, you're wasting your time. If your goal is to be an entrepreneur and run your own company, then while you're here trading time for money, you need to be educating yourself. Learning.

00:06:07:23 - 00:06:31:04

Paul Hutchinson

And so he had me find the best guys that were there. The average guy was making 20 sales a week. There's two guys make in 70, and he had me take them out to lunch on my dime and learn from them everything they're doing. And pretty soon I was making over 70 sales a week. Within weeks. He also said, Paul, your car should be a university on wheels. From now on, the rest of your life,

00:06:31:04 - 00:06:52:07

Paul Hutchinson

I don't even want you to know if your car radio works. Now, for your for your listeners, just so you kind of know, because I don't know if we can with this in the- but I'm I'm the founder of over 20 plus companies the largest one is a $43 billion real estate investment fund. And we we we're the number one performing real estate investment fund

00:06:52:07 - 00:07:09:13

Paul Hutchinson

of our of our kind for the first ten years that I was running it. We’re the top at emerging managers worldwide. So these principles that I'm teaching you now, although they were starting out small, I use these same principles when we built huge companies later, if that makes sense.

00:07:09:22 - 00:07:34:23

Matt Haycox

No 100%. I tell you. I mean, we've only been talking 5 minutes, but, you know, if anyone switches off or gets cut off at this point, I think, you know, those three things we just talked about, the importance of learning how to sell, the importance of learning how to handle rejection and the importance of always consuming knowledge, which obviously is, I guess, the translation of what you meant by saying that, you know, let’s hope your car radio doesn’t work.

00:07:35:08 - 00:07:35:13

Paul Hutchinson

Exactly

00:07:36:08 - 00:07:46:22

Matt Haycox

And it becomes a university on wheels, I guess listening to audiobooks, you know, consuming knowledge on the move. If you listen no further to this podcast and just take those three things away with you, it is the guaranteed route to success.

00:07:47:08 - 00:08:06:03

Paul Hutchinson

It'll change your life right there. In fact, it’s funny, years later, my kids told me, they said, Dad the only reason why you like eighties music is that's the last thing you ever heard because I just consumed audio programs on business leadership and success and all of these things that I could learn from other people. In fact, you what’s interesting.

00:08:06:05 - 00:08:24:18

Paul Hutchinson

I had a guy the other day and he told me, he said, Oh, Paul, he said, I would love to meet like Tony Robbins. I'd love to have a one on one meeting with him and have have a chat with him like like you do and have that. And I, I asked him this. I said, What do you think that he would teach you one on one that you're not already learning in his books and his tapes and everything else?

00:08:24:18 - 00:08:47:18

Paul Hutchinson

A lot of these great mentor leaders, you don't have to know them personally for them to be a great mentor for you because they're putting their great stuff that they can send out to the world in their books and tapes and things like that. So that's what they did. I consumed all that stuff. In fact, years later I ended up buying LeBron James’ Range Rover and this thing had like $60,000 subwoofers in the back of it.

00:08:47:18 - 00:09:04:23

Paul Hutchinson

And my kids are like, Dad, what are you going to do? Listen to all of your your self-help audio programs on those $60,000 subwoofers? I said I said the reason I could afford that car is because I was listening to that stuff. And so they started soaking it in themselves as well. So, yes, that transformed my life.

00:09:04:23 - 00:09:25:14

Paul Hutchinson

And those habits actually started when I was a teenager. I'm going to back up just a little bit because these things I think, are vitally important to the whole story, especially as an entrepreneur. In my, when I was like 14, 15 years old, I wasn't that popular in school. I was- I had buck teeth when I was younger and then I had braces and just having a hard time.

00:09:25:14 - 00:09:46:14

Paul Hutchinson

And so I went into my dad and I said, Dad, how how, how can I make friends? How can I be successful? What is the key to success? And he gave me two gifts that completely changed my life. One of them was that was a book that he had had since he was a teenager called How to Win Friends and Influence People by Dale Carnegie. Classic.

00:09:46:14 - 00:10:08:08

Paul Hutchinson

It was all tattered and stuff, an old black book. But I realized at that point in reading that that every person that I talk to is a thousand times more interested in them than they are in me. And if I can use a drop of honey instead of a gallon of gall, I can attract more an understanding that interpersonal relationships, skills and really talking and understanding people change my life.

00:10:08:11 - 00:10:32:04

Paul Hutchinson

And then the second thing, which is so powerful, was an audio program by Brian Tracy called The Psychology of Achievement. And this was one of his first ones, the classic one way back, what was this 40 years ago, 35 years ago? And I listened to that program Matt so many times that I actually broke, I had those old audio, those cassette tapes,

00:10:32:04 - 00:10:57:11

Paul Hutchinson

you know. I listened to it so many times that it broke and I had to tape it back together and screw it up with a pencil to give it back in. But that taught me that literally everything in my life I could create through my actions, through my words, and even my thoughts were bringing about these things into my life step by step, that I didn't just have to pound it and pound and do the work.

00:10:57:11 - 00:11:19:07

Paul Hutchinson

But the most important part was changing my mindset, where I needed to look in the mirror and shave a millionaire before I became a millionaire. I needed to see myself as a man of integrity to bring that into my life. I needed to see myself as as fit and healthy. And that visualization started bringing those those those truths into my life.

00:11:19:07 - 00:11:43:05

Paul Hutchinson

And especially when it came to business success, it would attract the right people, attract the right circumstances, and to visualize this world of abundance. Somebody asked me earlier today and he said- in another conversation. He said, Paul, he said, when you when you arrived, you know, when you were able to buy this this massive mansion, when you were able to buy these cars.

00:11:43:11 - 00:12:10:19

Paul Hutchinson

You know, how did it feel? How did- how- was that like totally out of- I said, you know what? It actually felt exactly like I imagined it would because your imagination sets the stage for your future. So those were all things that kind of formatted things in the beginning. And I built this this company, my very first successful company was the Midwest Center for Stress Anxiety.

00:12:10:19 - 00:12:44:01

Paul Hutchinson

We had an audio program to help people overcome anxiety and stress disorders. It was completely in line with my mission of I'm going to make a powerful, positive impact in the lives of others. At the same time that I'm creating value in the way of money coming back to us. And so being able to put together a program where I could truly help people change the negative patterns of thought, just like I did when I was 14, change those negative habit patterns of thought that were creating anxiety and depression in the first place.

00:12:44:01 - 00:12:53:07

Paul Hutchinson

I sold that company for over $20 million when I was 29 years old, and that's where we entered into being able to start building the fund. So that's a little bit of background

00:12:54:05 - 00:13:14:07

Matt Haycox

Let's talk about that fund then, because the numbers are obviously astronomical. I think my notes had 40 billion, but I think I think we spoke earlier, you said 40, 43 billion assets under management under there. I think you got something like 2000 employees. I mean, what was the concept? What was the genesis of the fund when it started and how did you go about scaling a business to that size?

00:13:14:07 - 00:13:41:01

Paul Hutchinson

Yeah, so I started out with one partner, me and a man named John Pennington. In the beginning we started a fund called Bridge Loan Capital. We were doing short term hard money lending, asset based lending. And where it came about is that the company that bought my marketing company when I was 29, they had some they had some products that they were buying out of out of Asia and they were selling to Best Buy and other things like that.

00:13:41:05 - 00:14:10:07

Paul Hutchinson

And they needed some float. They needed a 30 day purchase order financing type of thing. So we started out doing hard money loans or purchase order financing for companies that were doing that. For example, if you if you had a widget that you invented and you were having it manufactured in Asia and you you have to pay the manufacturer half a million dollars for the order, but you have a fulfillment order from Best Buy, that's going to pay you $1,000,000 as soon as it arrives at Best Buy.

00:14:10:08 - 00:14:27:00

Paul Hutchinson

But you somehow need a float that 30 day getting it over here. So that's what we would do. John had done $9 million a year in import export and he knew how to make sure we didn't lose a container full of of widgets coming in from China and make sure we got paid for it. So that's where we started.

00:14:27:06 - 00:14:32:20

Paul Hutchinson

And then we we transitioned over into real estate about a year later. But in the beginning...

00:14:33:12 - 00:14:36:06

Matt Haycox

Lending, lending on real estate, or buying it?

00:14:36:15 - 00:15:00:12

Paul Hutchinson

Exactly so in the beginning we were doing loans, we were doing bridge loans. So that's where the bridge name came from of the company. And and when we were first started, John and I were in this little teeny office. I mean, we built it up to $10 million under management in this office that was so small, we we would hit elbows when we turned around or if we stood up together, our chairs would hit and that's how small it was.

00:15:00:12 - 00:15:03:18

Paul Hutchinson

And we're paying like $300 a month for this little office.

00:15:03:18 - 00:15:06:09

Matt Haycox

Where were you raising the capital from?

00:15:06:19 - 00:15:29:10

Paul Hutchinson

High net worth investors. And I was clueless at the time. I didn't, you know, I would I had came from a marketing background and I told John, well, his let's just put a billboard out and whatever. He said, No. He said, this is a private offering memorandum. We can only bring in high net worth investors. And I remember writing on a piece of paper, where do I find high net worth investors?

00:15:29:10 - 00:15:50:22

Paul Hutchinson

And I started writing things on their okay, are they hanging out at the high end, really expensive gym. Are they front row seats that at the the NBA games? you know, what- where are they? And one of the things I wrote on there was charity work. And I realized a lot of these ultra wealthy guys and their families were were now involved in trying to really make a difference.

00:15:50:22 - 00:16:24:13

Paul Hutchinson

So I served on a bunch of different boards of directors, of different charities for two purposes. Number one, I believe that choosing to give back, even when you don't have the money, will energetically create more coming in. In fact, my mentor back in my early twenties, he said, Paul, if you make a decision today that you're going to give 20% of your money and 20% of your time to making a significant impact in the lives of others, he said the rewards coming back will not only be happiness rewards, they'll be financial rewards as well.

00:16:24:18 - 00:16:45:20

Paul Hutchinson

You can call it the universe, you can call it God, you call it karma, you can call it whatever you want to. I believe there's a higher power very interested in us doing good and making a difference in the world. And because of that, I've seen massive success come in my businesses by being involved in charity. And I met a lot of the high net worth guys in that charity world as well.

00:16:46:03 - 00:17:07:04

Paul Hutchinson

So back to me and John, we're in this little teeny office and John tells a story all the times they say John, how did you guys get so big from where you were? And he'll say, Paul had the vision right from the beginning. We'd be sitting in this little office and I'd be making phone calls trying to raise like we needed $25,000 more for a project that we were trying to fund by Friday.

00:17:07:07 - 00:17:27:10

Paul Hutchinson

And John would say, you know, Paul would be in there making calls, making calls, making calls, and about halfway through the calls, Paul would hang up the phone, and he turned around and he’d put his little pinky right here on his on his lip. And he'd say, John, we're going to be $1,000,000,000 fund someday. And John. John said, I just said, Paul, we need $25,000 by Friday.

00:17:27:14 - 00:17:53:13

Paul Hutchinson

Right? He couldn't see that. But but then we would sit down and talk and he would say, Paul, listen, you know that neither you or I have the education or the pedigree to run a multibillion dollar investment fund. And I said, Yes, John, but if we build it right from the beginning, if we build it with integrity and this is what I loved about John, is that he built everything with integrity.

00:17:53:17 - 00:18:14:02

Paul Hutchinson

He crossed every T, dotted every I, and I said, we build it with integrity and we have the vision of what we want to create. We will attract the right people that will allow us to build this company. And that's exactly what happened, is that that as we built this this company with the right foundation, we didn't cut any corners or anything.

00:18:14:02 - 00:18:38:17

Paul Hutchinson

We spent a lot of our own money with making sure all the paperwork was right with the Securities Exchange Commission and everything else, so that it was done right from the beginning. And sure enough, we were able to attract rock stars. Like unbelievably decorated pedigree type people that came on as our partners because they saw what me and John were putting together and the vision of where it was going

00:18:38:17 - 00:18:49:20

Matt Haycox

And tell me, as the fund developed up to the up to the billion- billion plus to the 40 odd billion it is now, has the mandate of the fund changed? I mean, is it still bridge lending or?

00:18:49:20 - 00:19:10:15

Paul Hutchinson

No. Yeah, I mean, here's what happened. Back in 2006, John and I, we had we had got it to the point where we had loans out on about $100 million worth of property. And we hired a guy named Don Hartman. Don's resume was the most impressive piece of paper that I had ever seen. He had run the Financial Institutions Division for Citigroup in Asia.

00:19:10:20 - 00:19:34:00

Paul Hutchinson

He’d raised $14 billion to bail out the Asian debt crisis in the late nineties. This guy was qualified. He jokes, and said, Yeah, Paul found me walking around Salt Lake City with an unemployed sign. I’ll work for equity. Right? I mean, this guy was overqualified for everything in Utah and we brought him on to help us have the look and feel necessary to go after the bigger institutional investors.

00:19:34:00 - 00:19:54:16

Paul Hutchinson

Because I didn't know how to get there. I knew that we with the audited financials of the returns that we had, I knew we could go to Morgan Stanley and have them write a $300 million check, but I didn't know how to get there. So we brought Don on to help us not only have the pedigree with him there, but to help us have the look and feel as a company to get to that point.

00:19:54:16 - 00:20:13:16

Paul Hutchinson

And then Don comes into my office. We're still doing these bridge loans. He comes into my office. It's December of 2006 and this is a year and a half before the 2008 crash. And he comes in my office and he said, Paul, we're in trouble. I said, like we like the fund? The company? He goes, No, we like the whole country.

00:20:13:17 - 00:20:40:14

Paul Hutchinson

He said, Probably the whole world. And he had all these third order polynomial equations that were way over my head. And he said, I've been looking at the numbers. He said, I think we're looking at a multitrillion dollar problem. And if you don't change, you're going to be upside down with everybody in this space. He said, But if we position ourselves right, we'll be able to take advantage of the greatest buying opportunity in real estate that we're going to see in our lifetime.

00:20:40:14 - 00:20:59:16

Paul Hutchinson

And he said, Here's what's important, Paul. You're really good at talking to people. You're really good at raising money. He said, You're really good. You and John have put together something. You're really good at running a fund and doing all the paperwork. He said, You don't know crap about real estate. You know, he said, Because all you're doing is just the lending,

00:20:59:17 - 00:21:20:10

Paul Hutchinson

the valuation. In a crash like this, lenders will be owners. So I suggest we augment the team and bring on some people who are true real estate adults who understand how to manage it. And then in real estate, he said. There's a lot of different asset classes and some of them do great in the good times and horrible in the bad times.

00:21:20:10 - 00:21:41:16

Paul Hutchinson

Other ones do pretty good in the good times and still pretty good in the bad times. And I said, okay, what are we talking about here? And he said, I suggest we start with B class multifamily. Apartment complexes that are a dollar, a square foot per month type of a thing, things that the average worker is going to be able to afford and not the high end stuff, he says.

00:21:41:16 - 00:22:02:21

Paul Hutchinson

Because when the crash happens, the crash will hit that really hard. Not land and things farmer type stuff that'll that'll that will not- they'll take a while to develop, etc., he said. But everybody needs a place to live and B class multifamily will will do really, really well. And so we started looking around to find some team members that- we were bridge loan capital.

00:22:02:22 - 00:22:24:03

Paul Hutchinson

We found a group called Bridge Property Management. They had a 20 year track record in managing apartment complexes with a 20% per year return. And so we brought them on as as partners. We combined together and created Bridge Loan Capital, Bridge Property Management. We created Bridge Investment Group. They had never run a fund before, but they knew how to manage property really well.

00:22:24:04 - 00:22:48:14

Paul Hutchinson

And from there, now we- and because Don saw the writing on the wall before the crash happened, we got in the right position at the right time. We got rid of any of our lending, any assets that were going to really cause us problems and we got in a strong cash position. And we became one of the first funds in the country to be qualified on the top level purchasing platform with all the GSEs, Freddie, Fannie, HUD, FDIC.

00:22:48:18 - 00:23:04:11

Paul Hutchinson

So when a bank was ready to fail, we would get a call and we were able to go in and buy these things at pennies on the dollar. And we created a win win win even for the bank, because at this point, the bank president is willing to negotiate. He realizes 30 days from now, the FDIC takes him over.

00:23:04:11 - 00:23:30:05

Paul Hutchinson

He's out of a job and his shareholders have a big fat zero. Or we go in and we can buy a $100 million portfolio for $30 million and he gets the liquidity he needs. We're able to take this apartment complex that wasn't being managed well by the bank and create added value and create a win not only for the bank but now for the tenants as well, because we know how to manage those apartments and create that extra value and sell them.

00:23:30:09 - 00:23:51:03

Paul Hutchinson

We ended up with a 40 plus percent IRR return in 2009- in 2010, 2011. Where the rest of the market was crashing and lost 30% and 50%. So listening to somebody like Don, bringing on the right team, being in the right place at the right time allowed us to create a powerfully strong foundation to catapult us to where they are today.

00:23:51:05 - 00:23:58:23

Matt Haycox

And what do you do with those properties over the long term? Do you keep them for the, for the long term hold, the long term yield? Or once the price is right, you flip them?

00:23:58:23 - 00:24:29:00

Paul Hutchinson

Yeah, we're we're a fix and flip on a big scale, right? So we we would find properties that needed some love in some way. They needed to have what I call a story. Either they had a messed up management team or messed up marketing strategy, or they need to have value add improvements in the property themselves. And so we would we would buy these ones that were mismanaged and we would put in our management skills and then we would do things like we would make sure that what we were doing was not only right for our investors, but it was right for the tenants as well.

00:24:29:00 - 00:24:51:10

Paul Hutchinson

For example, a lot of our apartment complexes were in areas that were were heavily Latin-American. Hispanics that were coming in in these areas. And a lot of these apartment complexes were, you know, the B class ones that were built, you know, 20 plus years before they had tennis courts and stuff. But they they had four foot weeds growing in the tennis courts and our tennis didn't play tennis.

00:24:51:10 - 00:25:14:00

Paul Hutchinson

Right. The Hispanic people they like soccer. Right. So we took down the nets and we put little soccer fields in and create little soccer leagues. We would bring in English as a second language in the bookmobile and a tutoring program and Taco Tuesday and all these beautiful things that blended with the culture of our primary people that were living there created a good, safe place to live.

00:25:14:01 - 00:25:38:20

Paul Hutchinson

We we didn't put gold tile rods and in a B-class class neighborhood. Right. But but we're going to make sure that we have a workstation placed there for people to bring their kids to with tutoring and things like that. So bringing that kind of value as well as making sure that the pools were taken care of and they had the soccer leagues in place, that kind of value allowed us to take the properties up to a 97% success rate.

00:25:39:00 - 00:25:59:23

Paul Hutchinson

9% occupancy rate, and hold it out long enough, where then we could sell it off to a read or something that could just go ahead and clip the coupon and make a return for them. But we're getting a massive return. We averaged a 23.2 net per year return for our investors over a 15 year period. That's fantastic.

00:25:59:23 - 00:26:21:15

Paul Hutchinson

So this is this is all because of listening and finding the right people, not being intimidated to bring on power players, on our team and listening to them when they saw the writing on the wall and then we could take- They say that you make money when there's blood in the streets. That's true, But I don't like to make money from the blood on the streets.

00:26:21:18 - 00:26:30:18

Paul Hutchinson

I like to make money from creating the- The first aid kits to help people that have the- that are having a challenge when that happens, if that makes sense.

00:26:30:18 - 00:26:57:17

Matt Haycox

No, of course. And tell me, I mean, obviously running running billion dollar businesses is something that 99% of the world only ever get to read about. What would you say are, if any, the material differences that you've noticed in running something of that scale? Or is it just when you go from a million to 10, 10 to 100, 100 to billion, billion to 40 billion, are there massive shifts in methods of operation or is it just doing the same thing at scale but being more organized?

00:26:57:17 - 00:27:21:10

Paul Hutchinson

Yes, the key you've got- You've got to have systems for everything, systems for everything so that you can duplicate it on a mass scale. So we we created those systems when we were small to make sure that they would work perfectly when when they're bigger. In fact, a lot of us as founders. You know, John and I, we we kind of did everything in the beginning.

00:27:21:10 - 00:27:44:16

Paul Hutchinson

In fact, a funny story, when I- right before I retired, I retired in 2017 just to focus full time on charity work. But right before I retired and now I'm still I'm still a founder, I'm still an owner and the GP of the funds, etc. But I got way smarter people than me that are running the show. But right before I retired, one of the we had we had actually 4000 employees back then.

00:27:44:16 - 00:28:05:07

Paul Hutchinson

We scaled down the employees and outsource some of the things since that time. But so at the time I retired, we had about 4000 employees. We had 70 plus employees that were in accounting alone. One of them, his name was Andrew. He was new there and didn't know the history of the company. And he comes and his job that day was to have the partners sign off on our expense reports.

00:28:05:07 - 00:28:24:09

Paul Hutchinson

And so he comes in and on my expense report, I've got I've got trips to Dubai and you know, I've got front row seat at NBA games and nice restaurants with wealthy people. And he asked me, he- I'm signing off on it. And he said, Paul, he said, he didn’t say Paul. He said, Mr. Hutchinson. He said, Do you mind me asking, how did you get your job?

00:28:24:14 - 00:28:40:16

Paul Hutchinson

And I realized he didn't know the history of the company and I said, Well, what do you mean? He goes, Well, you you have you have the best job in the whole company. All you do is fly around and go to lunch with rich people. Because I was, you know, I was capital markets at the time. And so I decided to mess with him a little bit.

00:28:40:16 - 00:28:58:02

Paul Hutchinson

And I said, Well, Andrew, I used to do what you did. He goes really? You were in accounting? I said, Yeah, I had that, which I was when it was just me and John, right? I said, Yeah, I had it, I had this spreadsheet, this, the Excel spreadsheet that I was keeping track of the net asset valuations of all of the investors in the fund and all of this stuff.

00:28:58:02 - 00:29:15:24

Paul Hutchinson

And it was like 70 megabyte spreadsheet, I said, And then Adam worked for our accounting, for their auditor. Now Adam is now his boss, right? I said, So Adam came in and did all of our audits and he said, Paul, he said, All of your numbers are right, but there’s a hell of a lot easier ways of doing it than what you're doing.

00:29:15:24 - 00:29:34:08

Paul Hutchinson

I said, So I got replaced by Adam, you know. So basically I hired Adam to take my place. And then he said, I said, And then I did what Jonathan does. He goes, Really? You were underwriting assets? Yeah. I have this huge stack of papers in which I was going through all of these assets and trying to figure out what the values were, etc. And every night I went home with a headache.

00:29:34:08 - 00:29:48:00

Paul Hutchinson

And so we got I got replaced by Jonathan. And so I said the only thing I was any good at was going to rich with- going to lunch with rich people. So that's where they put me. And so. So then he's like, Holy crap. So how many people were here when you started? I said, Just me and John.

00:29:48:03 - 00:30:02:04

Paul Hutchinson

So the principle and teaching there is, as an entrepreneur, learn every part of your business, but don't be afraid of hiring somebody who is way better than you at each one of those areas as you grow.

00:30:02:19 - 00:30:21:24

Matt Haycox

Perfect, perfect. Listen, I want to go on to talk about the work, the charity work, the the child trafficking and your involvement in that. But just before we do, just want to wrap up the entrepreneurial side with a, with a question that someone was asked us on Facebook here, actually, which says, I'll read it out, it says, You can only get a loan if you have equity.

00:30:22:07 - 00:30:41:09

Matt Haycox

So what's your advice for me on my business? Because I have no equity, but my business venture is six years of knowledge. I've produced nine journals, but I've written 52. What's your advice on how I can develop all 52? I mean, I guess I guess the the summary of the question is how do you go and find equity investors?

00:30:41:19 - 00:30:44:10

Matt Haycox

How do you raise capital for a small business?

00:30:44:10 - 00:31:12:03

Paul Hutchinson

Absolutely. And here's here's the answer. There's different types of equity. You know, there's there's physical value equity, which we did when we were doing the bridge loans and stuff. We have to say, okay, if you've got a property that's worth $5 million, I’ll loan you $3 million on it. So I have a good loan to value type of thing, but but somebody like this gentleman, he's got equity in his assets, his knowledge, his experience, etc..

00:31:12:03 - 00:31:39:02

Paul Hutchinson

So those type of lenders are not going to be your traditional lender. They’re not going to be the banks. They're going to be more private lenders or guys who are willing to come in with with some sort of an equity stake. So if he's got if he's got some great ideas, if he's got a track record, that is equity, that that is there's value there, there's value in his experience, there's value in what he's created so far.

00:31:39:06 - 00:32:00:18

Paul Hutchinson

And so somebody who who understands that value, somebody who's maybe has some money that that has has been in the, in the same industry as him would be a great person to go to who could say, Hey, I believe in you, I'm going to lend you money on this, or I'll take a piece of your company as we're building it, etc..

00:32:00:18 - 00:32:08:08

Paul Hutchinson

So so yeah, that's those are less traditional, but there's there's equity there for somebody who understands the value of your company

00:32:08:09 - 00:32:29:20

Matt Haycox

I'm loving this chat, I got to say. I mean, obviously you and I never got a chance to speak speak too much before we started, but there's so many similarities in our- in our story, in our business. My core business is what you guys in America call hard money lending. You know? So, I mean, I mean, I spend my days having lunch with rich people to to raise capital so that I can deploy it on unsecured debt in the UK.

00:32:29:20 - 00:32:52:21

Matt Haycox

So many of your principles are either things that I operate or believe in or try and operate in, believe in myself. So I'm certainly getting some good value here. And I know I know the guys who get to watch and listen to this will be also so it’s been great having you here so far. Listen, let's take a- let's take a dramatic swift then from, you know, from building billion dollar funds and talk about your work in rescue missions for child trafficking and how that came about.

00:32:52:21 - 00:32:55:14

Matt Haycox

And I mean, how do you even get involved in that space?

00:32:55:14 - 00:33:15:21

Paul Hutchinson

Yeah, this is super unique. It's not something that the average person would even even want to be involved with. But as we touched on earlier, I made a commitment in my early twenties that I would donate a significant amount of my money and my time to making a difference in the lives of others and to charity. And so I served on a number of different charity boards.

00:33:15:21 - 00:33:35:04

Paul Hutchinson

I was on the Make a Wish board of directors for seven years. I was the incoming chairman for Make-A-Wish here in Utah when when I got a call from a friend of mine who's now the attorney general in Utah, his name is Shawn. And Shawn introduced me to a man who was part of Homeland Security working in child trafficking.

00:33:35:04 - 00:34:01:10

Paul Hutchinson

And he came to this. We had a guys movie night and he showed up there and I was like, oh, he has a movie night. I don't want to be listening to this guy and him trying to raise money for his his charity, whatever. But we gave him the- the chance to speak and it changed my life. Matt, this guy started talking about the fastest growing criminal enterprise in the world, which, I mean, this is a dark subject and I'm not going to go deep into this dark subject, but I am going to say this.

00:34:01:10 - 00:34:23:16

Paul Hutchinson

There's more today, and I'm not talking about just children being abused at home. I'm talking about sold human beings. There's more today than all 300 years of the of the transatlantic slave trade put together. So he he talks about how he found some children in Cartagena, Colombia, and was putting together this this rescue mission. He thought there was 20 of them down there.

00:34:23:16 - 00:34:36:20

Paul Hutchinson

He then calls me a couple of weeks later and he said, Paul, he said, and we had helped to raise some money to help rescue these these 20 children and these children are being sold for horrible things. They were kidnapped and abducted children and whatnot. And-

00:34:37:01 - 00:34:52:15

Matt Haycox

I mean, I was just going to ask. I mean, I know it's probably a naive question, but it's you know, it's not really my area of specialism. I mean, what happens to these kids when they’re trafficked. I mean, are they being- are they being trafficked for the sex trade or to be made to be made into illegal workers or-?

00:34:52:15 - 00:35:20:01

Paul Hutchinson

Yeah, all the ones that were doing are being sold for organ harvesting and sex trafficking. The 8 million children that are being sold for those type of things is what we focus on. There is hundreds - 8 million?! - 8 million. Now, there's a bigger number if you're talking about labor, children that are underage, that were labor trafficking, etc., But I'm talking sold human beings that are being sold specifically for sex trafficking and organ harvesting.

00:35:20:01 - 00:35:43:06

Paul Hutchinson

So this is why nobody talks it. It's a dark subject, right. And so so I get this call. And he said, Paul, he said, I'm here in Cartagena, Colombia. There's not just 20 children here. There's more than 50 that are part of this ring, he said. And there's more than 100 children in the surrounding ci- in other cities down here that we believe are tied to the same trafficking organizations. He said,

00:35:43:11 - 00:36:03:08

Paul Hutchinson

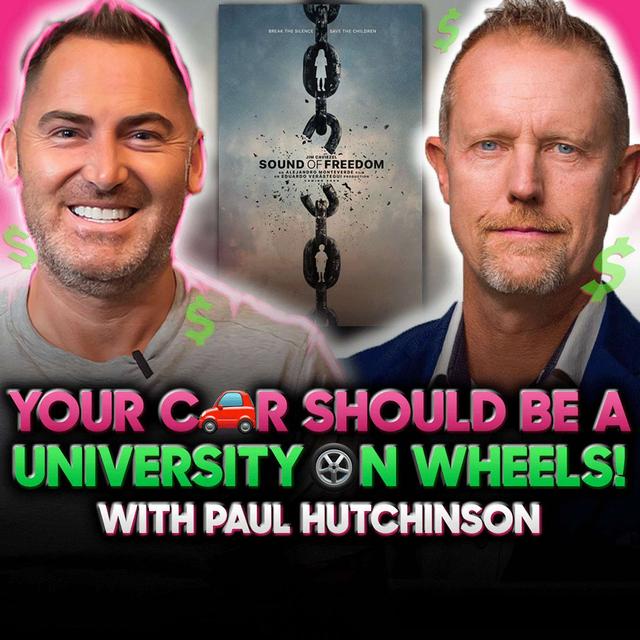

We have a plan that we could rescue all 100 plus children at the same time on the same day and get them back to their families. He said this will be the largest child rescue operation in one day in history. Now, the story that I'm telling you right here is coming out in a movie later this year, we've already filmed it.

00:36:03:08 - 00:36:27:24

Paul Hutchinson

The name of the movie is called The Sound of Freedom. And the actor who plays the homeland security agent is Jim Caviezel. Jim played Jesus and Passion of the Christ and Count of Monte Cristo, he was the count. The actor who plays me is named Eduardo Voracek. Eduardo is one of the more famous actors in Mexico, and because we filmed it while I was still doing a lot of undercover work, he doesn't play Paul Hutchinson.

00:36:27:24 - 00:36:33:08

Paul Hutchinson

He plays Pablo Delgado, the billion dollar fund manager who quits his job to go rescue kids, right

00:36:33:12 - 00:36:35:21

Matt Haycox

The Hispanic Paul Hutcherson.

00:36:35:21 - 00:37:01:01

Paul Hutchinson

Exactly. And so, so the story I'm telling you is the storyline of that. It starts out with with Tim, the Homeland security agent who's starting out in anti-trafficking work that ends up coming into starting a foundation. And that's the one who called me while I was in the U.S. and he was in Colombia, and he said, we have a plan that we could rescue all 100 children at the same time.

00:37:01:01 - 00:37:16:15

Paul Hutchinson

But I need your help in a big way. And I'm like, what do you need? You need any money? Should I write you a check? He said, No bigger than that. If you can be in Colombia in two days, you can be part of this massive operation. And I said, Well, why me? What, what, what do you need from me?

00:37:16:15 - 00:37:36:11

Paul Hutchinson

And he said, Well, he said, the head trafficker down here has a piece of property that he wants to develop into a child brothel sex resort, just like Jeffrey Epstein House. It's actually an island that he wanted to develop. He believes he can make tens of millions of dollars a year bringing horrible people down here to do horrible things.

00:37:36:11 - 00:37:57:02

Paul Hutchinson

But he needs $8 million to develop it. He said, I can't teach my Navy SEALs how to negotiate this deal with him. He said, If you can be here in two days and play that role, then I believe that- I said, Well, what do you want me to do? He said, Well, you let him know that you're willing to fund his $8 million project under one condition.

00:37:57:03 - 00:38:14:10

Paul Hutchinson

In two weeks, we're going to have a party and you're going to bring down a bunch of your buddies. And if he calls all of his friends, all of his connections that are traffickers and have them bring all their children to the same place on the same day, he said, we'll perform the sting at that time and we'll rescue all those children.

00:38:14:13 - 00:38:33:12

Paul Hutchinson

He said, Tell him that the only way you're going to fund his project is if he performs and shows you that he can provide that many kids. So he knew more about my background than most people. I have a special set of skills from previous training, etc. But more importantly, he needed my ability to negotiate a real estate deal.

00:38:33:12 - 00:38:56:22

Paul Hutchinson

So two days later, I'm in Colombia. I’m face to face with the most evil people I've ever encountered selling 8-10 year old children. There's four people sitting across this table from us. There's three guys, one female. She was Miss Cartagena. She had this fake modeling agency. She was going to towns in South America and telling the parents, Oh your daughter’s too pretty to be working in the field.

00:38:56:22 - 00:39:22:16

Paul Hutchinson

She should be a model. And the parents would bring them to their photoshoots and boom, they would disappear. So all of this is in the movie, and this follows the story of some of these children that were brought in. So I'm sitting there at this table, we negotiate this this deal, and they were so excited that we're willing to take a look at it that, over the next two weeks, he called all these other traffickers. And sure enough, he was able to get them to bring all of the abducted and kidnapped children that they have to the same place.

00:39:22:16 - 00:39:43:02

Paul Hutchinson

We did three separate scenes on the same day. One in Cartagena in which they brought 54 children. Almost every one of them was under the age of 16 years old. More than half of them were kidnapped, many from other countries and they're- the other ones were in Medellin and Armenia, Colombia, all simultaneous things. We called it Operation Triple Take.

00:39:43:05 - 00:40:05:19

Paul Hutchinson

These guys show up with all of these children, and we put the children in a separate part in the house because they were already traumatized enough. We didn’t want them seeing the guns and the money changing hands etc. And we're sitting down at this table and Fuego, one of the, one of the traffickers, He stands up and he goes, Pablo, he said, I, I have, I want to show you the gifts that I brought you. And Matt, this changed my whole life right here.

00:40:05:19 - 00:40:21:01

Paul Hutchinson

He went in the house. He was in there for about 10 minutes, and you could hear two of the children crying. They were so scared of coming out and meeting us. In fact, there was a CBS article that goes through this. And you can see my face is blurred out and whatever. They were so scared of meeting us.

00:40:21:06 - 00:40:39:18

Paul Hutchinson

And 10 minutes later he comes out and he has four virgins scared to death. Three little girls, one little boy. This little boy was 11 years old. They gave him cocaine that morning because he was so scared. What kind of effed up monster thinks that that's attractive? You know, every cell in my body wanted to just hug these kids. Say, You're going to be fine.

00:40:39:18 - 00:40:55:22

Paul Hutchinson

You're going to see your parents again. I couldn't say that. I'm standing in front of this little girl. She's 11 years old, standing up. She wasn't much taller than I was sitting down. And there was tears stains on her makeup face and and and every cell in my body wanted to just say, You're going to be fine. You're going to see your parents again.

00:40:56:04 - 00:41:28:03

Paul Hutchinson

And and she she was standing there. And I took her little hands and and I asked her, I said, ¿Cómo se llama?. What's your name? And she didn't know her name. I'm sure that's because her real name wasn't Princess. That's what the traffickers were calling her. She was so scared. And and I just said, Está bien. It’s okay. She went back in the house and the most beautiful moment of my life after- up to that point was, was after the agents came to storm the party and arrested everybody. 30 Child Protective Services, people came in with the children and they started laughing and singing with the children just to calm them down.

00:41:28:06 - 00:41:47:14

Paul Hutchinson

And that laughing and singing, that sound of freedom was the most beautiful sound that I ever heard. I started crying. That's why we named the movie The Sound of Freedom. And they weren’t supposed to tell the kids that we were the good guys. But somebody must have said something because that little girl that was standing in front of me with the tear stains in her makeup face, she was standing there by the window.

00:41:47:14 - 00:42:06:09

Paul Hutchinson

Her hand was on the window. She was crying again. But but she was smiling and waving at us. And she said in her broken English, she said, Thank you, Americans. I just broke down and I turned it to Shawn, who is now the AG. And I said, Shawn, I saw- that changed my whole life. I said, I make- I spent my whole life making rich people richer.

00:42:06:18 - 00:42:19:20

Paul Hutchinson

I want to make a difference. I want, I want, you tell me what I need to do. I'll write a big check, I’ll- I was going to buy a Lamborghini, I was going to buy an Aventador that year. And I said, You know what? I'm going to write the check. I want to I want to figure out how to make a difference.

00:42:19:20 - 00:42:44:19

Paul Hutchinson

And he said, Paul, he said, here's how you can make a difference. He said, Unfortunately, the majority of demand for this horrible act in second and third world countries comes from wealthy men in first world countries who look and dress and talk like you, he said. I can't teach my Navy SEALs how to wear a $4,000 suit and a $50,000 watch and negotiate a multimillion dollar deal, He said.

00:42:44:19 - 00:43:02:24

Paul Hutchinson

And I, I don't know of any ultra successful business owners who's had the training that you've had, he said. If if you're willing to be the bait, it’ll change your whole life. So that was ten years ago. And I've led, led or been involved with over 70 undercover rescue missions in the last ten years.

00:43:03:03 - 00:43:10:03

Matt Haycox

And these missions, these missions are always in the third world countries are they or have you actually had done them in first world countries too?

00:43:10:07 - 00:43:26:21

Paul Hutchinson

We've done them all over. I've led rescue missions in 15 countries. But the majority of the problem are in places like Southeast Asia, Latin America. But but we've done rescues in in Africa and India and a lot of other places. So it's a problem.

00:43:26:22 - 00:43:36:01

Matt Haycox

And tell me, do the kids always get back to their parents at the end as well? As in like, do you even know who the parents are? Do they know that?

00:43:36:13 - 00:44:01:11

Paul Hutchinson

If their parents, if their parents reported them abducted, then it's easy to find them and it's easy to get them back if they didn’t, sometimes the parents were involved. You know, in Southeast Asia, more than half the children that we rescued in places like Thailand, more than half of those children were sold by their own families. And if that happens, we don't want to get them back to the same family and have them be sold again.

00:44:01:12 - 00:44:29:05

Paul Hutchinson

So we find them healthy homes. We've got thousands of families that are- There's families all over the world that are that are willing to sacrifice the next 10 to 15 years of their life with a challenge child, they maybe don't have the money to be able to to to make it happen. So we help raise money. We've had some some other foundations that we have funded that that specifically focus on the legal work to get those children into healthy homes.

00:44:29:10 - 00:44:36:22

Matt Haycox

Well, tell me about the Child Liberation Foundation. Is that is that something you founded recently or was that, was that at the beginning of this journey?

00:44:37:09 - 00:45:07:05

Paul Hutchinson

Yeah. So so we were with some other foundations in the beginning and about five years ago, we wanted to make sure that we knew where every penny was going, that we knew that every penny was going to the rescue, rehabilitation or reuniting of children with their families. A lot of foundations out there are well-meaning, but a lot of them have have high overhead, and they're using the money to promote their own logo or different people's ego, etc..

00:45:07:05 - 00:45:29:23

Paul Hutchinson

And so we funded a lot of different groups. And I have I have I have a lot of love for the organization that brought me on in the beginning. But the Child Liberation Foundation, we started about five years ago, its mission is eradicating child trafficking and we have funded a lots of other organizations and given them money to help go undercover and rescue kids.

00:45:29:23 - 00:45:55:22

Paul Hutchinson

And we've done a whole bunch of that as well. But the transition that's happened recently and this is the reason why we're even talking publicly, I've come to a realization that just going undercover and rescuing 20 children at a time is never going to fix the problem. This problem ten years ago when I started, is worse today than when we started.

00:45:56:00 - 00:46:12:03

Paul Hutchinson

And I've led 70 missions and the other foundations have led hundreds and hundreds of missions. And there's still a challenge out there and it's still growing. And the reason behind it, you cannot fix a problem by just pulling the kids out. You have to you have to fix the demand.

00:46:12:20 - 00:46:30:08

Matt Haycox

But I mean, I was going to say, you know, I mean, how how do you do that? Because, I mean, we talk in general about, you know, when when you just go and do something for someone, you know, if you haven't educated them, you know, then then it's just going to repeat, etc.. But I mean, how how, how the fuck do you remove the demand on something like this?

00:46:30:16 - 00:46:38:22

Matt Haycox

Because I mean, you’re not, you're not talking about a lack of education. I mean, you're talking about absolute fucking psychopaths and horrendous people

00:46:39:09 - 00:47:06:17

Paul Hutchinson

Absolutely. But here's here's the challenge Matt. I believed for a long time that the people who are going down and doing these horrible things, I, I thought I thought that it was tied to pornography addiction. Where, when you go from taking a woman from a divine feminine to an object, you start going down a dark road. And for a lot of them, that dark road, they start wanting, they're addicted and they want something harder

00:47:06:17 - 00:47:38:03

Paul Hutchinson

to have that same fix, and for some of them, harder is a little bit younger, a little bit younger. And pretty soon they're fantasizing about something they wouldn't have even thought was attractive five years ago. And then they're acting out on these horrific fantasies. That's that's where I thought all the demand was coming from. But I've come to an understanding recently as I really looked at some numbers and looked at the people that are involved, I've come to an understanding that, yes, 8 million children is is an unfathomable number, but it's small compared to what the real problem is.

00:47:38:05 - 00:48:06:23

Paul Hutchinson

And here's the real problem. One out of every five men here in the US and likely even more overseas, one out of every 5 - 20% of all men have experienced sexual violence against them sometime in their lives, and one fourth of them experienced it under the age of ten years old. That is 200 million men who have experienced that type of violence before the age of ten years old.

00:48:07:02 - 00:48:26:12

Paul Hutchinson

And they're growing up with this this trauma that is deep buried inside of them. And some of them, they grow up with big egos and big money and they're thinking deep inside, Oh, I was raped as an eight year old. It's not going to hurt if I rape somebody else. Right. It's this really fucked up version of what what sexuality is.

00:48:26:13 - 00:48:47:19

Paul Hutchinson

Now. That number is double when it comes to women. 40% of all women have experienced sexual violence. And one fourth of all women, a billion women on this planet. It happened as a child. So we've got generational trauma. And if we can figure out how to help people heal, not just- I mean, everybody can get all excited. Yeah, let's go in and rescue these kids.

00:48:47:19 - 00:49:14:04

Paul Hutchinson

Rescue these kids. I'll tell you this right now, Matt, if you if you put me in a room and you said, Paul, you've got 100 pedophiles and you've got 100 traffickers and you've got one hour and you can either have a gun with no retribution for an hour or you can have a microphone. I would take the microphone, and that would be the most transformational 60 minutes of their life.

00:49:14:04 - 00:49:32:13

Paul Hutchinson

I would take them into the pit of hell. I would show them the depravity of the direction that they're going and what they have done. I would pull them out and I would at least point them in the direction and teach them how they can let go of all that bullshit and get to a point where they can live a healthy life.

00:49:32:13 - 00:50:04:09

Paul Hutchinson

Now, I'm still going to lock them up because they need a spend- Spend some time to make sure they can never hurt another child again, period. But I believe that there's a pathway to healing. And on that note, I can do the same thing. You put 2000 men, just average off the streets, me realizing that 20% of them in that room have experienced that type of trauma and the other ones third party have experienced it in some way in dealing with maybe a parent or a grandpa or an uncle or whatever else.

00:50:04:09 - 00:50:31:16

Paul Hutchinson

And there's this trauma everywhere and teaching people how to heal and how to how to tie in to this this beautiful life that is inside of each one of us and learn to listen in a way that it can guide us in our lives so that we're not going down these dark roads. That's the answer. I've come to an understanding that my role is not just rescuing a ten year old from the clutches of a trafficker in Ecuador.

00:50:31:19 - 00:50:54:24

Paul Hutchinson

My role is helping to rescue the ten year old inside of every man and woman who has dealt with some degree of trauma in their life and help heal that trauma before they become contact offenders. If you understand where I'm going with that, I believe that a huge number of the people who are doing these atrocities, have trauma themselves.

00:50:55:06 - 00:51:06:04

Paul Hutchinson

So if I can help them heal that trauma before they cause that trauma on others, we're going to save millions of children, not just 20 at a time.

00:51:06:10 - 00:51:30:21

Matt Haycox

We’ve just had a comment on here actually that says, I've raised 17k for charities when I was working three jobs and building my business. The reason is because I was fostered five times, moved homes 32 times, abused for seven years. And I'm open about this, but I see a lot of solutions to lots of abuse situations because I was in it. It’s one reason that I'm building the businesses

00:51:30:21 - 00:51:42:15

Matt Haycox

the way I am. My abuser was a sadistic, barbaric pedo. He was abused by his uncle and brought that to my life. And that’s where 1Tuffpeach came from.

00:51:42:21 - 00:52:19:16

Paul Hutchinson

Exactly, exactly. So his trauma, this- I am I'm so grateful that there are people like this who have instead of doing what was done to him, which was a pass on of trauma. So what came to him was a chain reaction. Somebody who has had trauma, somebody else had trauma. And what's exciting about that guy is that generational trauma is stopping with him. Instead of allowing it to destroy him and putting him into a place where he could destroy others lives, he instead decided to take that trauma and build a successful company, raise money for charities.

00:52:19:24 - 00:52:26:16

Paul Hutchinson

That's the type of people who are going to change the world is the guys who stop that trauma in one generation, I love it.

00:52:26:22 - 00:52:45:12

Matt Haycox

So tell me because, I mean, undoubtedly people who are listening to this or watch this, you know, when we when we produce it off of the live version over the next few weeks, they're going to be both have their minds open and want to get involved because, I mean, I guess we've all heard of child trafficking of of human trafficking.

00:52:45:15 - 00:53:02:01

Matt Haycox

But probably I mean, I certainly never had any concept of the scale of it. And like you say, there’s the published scale and there’s true scale. How can people get involved? You know, what can they do, whether that's something to do with your foundation or just just just in general, how can people make a difference in this?

00:53:02:01 - 00:53:30:20

Paul Hutchinson

Well, here's what's exciting. The guy that just texted in, that's what everybody can do. You know, you don't have to get involved with my foundation if you want to. You can go to liberateachild.org or liberatechildren.org. Or just look for Child Liberation Foundation and you'll find us. There's some great resources and stuff there. Or do what he's doing, you know, help out with foster homes because he's been through some. Or raise money for different types of charities that are in your area that are making a difference.

00:53:30:20 - 00:53:56:13

Paul Hutchinson

They can get some more information on what I'm doing moving forward. I'm writing some books that will be out later this year that I really believe are going to make a power full impact in the lives of everybody that that is fighting this. And you can follow me on on PaulHutchinsonOfficial.com. You can go to Instagram or Facebook or LinkedIn to just look up Paul Hutchinson official and you'll find me.

00:53:56:13 - 00:54:07:22

Paul Hutchinson

I'm going to get something shorter because Paul Hutchinson Official is kind of long. I'm thinking something like, I don't know, Soul Healer 007. Or something like that. - The Hutch. The Hutch - The Hutch, that’s right.

00:54:10:00 - 00:54:34:05

Paul Hutchinson

So. So yeah, I would love to- and if anybody has connections with great people like you, Matt, that have podcasts, that have platforms. I'm willing to do podcasts every day and share from my heart and help people see the light and and understand what's going on in the world and get involved with with whatever charity. I'll tell you this, it doesn't have to be this charity.

00:54:34:07 - 00:54:58:15

Paul Hutchinson

Find something that you're passionate about. I don't care if it's saving the trees or saving the whales or saving the kids, whatever it is, find something that you're passionate about, that you can make a difference in and just write a check, but get physically involved in making a powerful, positive impact in the world and the blessings that will come to as you build your business will be tenfold.

00:54:58:15 - 00:55:26:08

Paul Hutchinson

And I have so many examples of making that decision, to write the big checks, to help out who really needed help and boom, these beautiful things would happen. I found that if I worked really hard at my financial goals, I had decent results because I worked my ass. But if I worked really hard and tried to have a powerful, positive impact on the lives of others, I had enormous results in my business goals and and and they very seldom do

00:55:26:08 - 00:55:40:02

Paul Hutchinson

those results come from my own efforts. They always came from, call it karma, call it what you want to. Beautiful things will happen in your your journey to success as you prioritize your time and your money to making a difference in the lives of other people.

00:55:40:13 - 00:56:04:17

Matt Haycox

Well, Paul, It's been an absolute pleasure talking to you, buddy, and you know, it's certainly been an eye opener for me. An interesting warm up talking about business and then a very eye opening and I guess saddening but inspiring at the same time, you know, conversation about about the people trafficking. So and like you say, I will do what I can to introduce you to some of the people where you can where you can share your story and share your message because it has been absolutely fascinating.

00:56:04:17 - 00:56:11:01

Matt Haycox

And, you know, I'm sure there's so much that people can do, as you said. I mean, you can- people can get you on official- Was it Paul Hutchinson Official?

00:56:11:12 - 00:56:29:21

Paul Hutchinson

PaulHutchinsonOfficial There's no G in Hutchinson, just H U T C H I N S O N. PaulHutchinsonOfficial.com or on Facebook or LinkedIn. I’ll be sharing a lot of a lot of different links to podcasts and things that we're doing or get involved with, liberateachild.org, or liberatechildren.org. and see us there.

00:56:29:23 - 00:56:44:15

Matt Haycox

And we'll we'll put in all the show notes on this as well. I know some of you guys are watching this not live now, listening to it live for everyone who hears the after version, all the information will be in the show notes and we'll put some some good link through to Paul in these organizations and backstory and everything as well.

00:56:44:16 - 00:57:01:24

Matt Haycox

So thanks a lot. Thanks a lot for listening. If you've been listening or watching live. Thank you very, very much. We don't get to do these live too much anymore, but thanks for Paul, for braving the chance to to make any mistakes in public. And when you guys get to hear this over the next couple of weeks, I'm sure I'm sure you'll love it, too.

00:57:01:24 - 00:57:21:16

Matt Haycox

So thanks a lot, as always. I've been TheMattHaycox. That’s T H E M A T T H A Y C O X on all things social. If you’ve been watching this on YouTube, you can hear it on the audio versions on iTunes or on Spotify, wherever you listen to your podcasts. And if you've been listening to the audio versions, jump on over to YouTube and you can see my pretty face too. Until the next time.

00:57:21:17 - 00:57:22:20

Matt Haycox

Thank you very much for watching.

00:57:23:12 - 00:57:25:23

Paul Hutchinson

Beautiful.

Billion Dollar Investor to Rescuing Children from Trafficking! Podcast w/Paul Hutchinson

Episode description

Tell us what you like or dislike about this episode!! Be honest, we don't bite!

Todays guest has an incredible amount of accolades with some amazing stories to tell with it all. Paul is a retired co-founder of the multi billion dollar company Bridge Investment Group, a large real estate investment firm based in Salt Lake City, Utah. And that is just one of the many businesses he's worked to set up. After retiring in 2017, he has spent a significant amount of his time in philanthropy leading rescue missions in many countries to save children from trafficking and much more.

We believe in a lot of the same principles and he delivers some top tips I know you'll find useful as prospective entrepreneurs. Do not miss this podcast packed with top tips for entrepreneurs and incredible stories about making the world a better place!

Links to The Sound of Freedom movie!

https://www.imdb.com/title/tt7599146/ https://www.soundoffreedommovie.com/ https://youtu.be/7oZE2nod4i0 - Trailer

Paul's Socials https://www.paulhutchinsonofficial.com/

https://www.instagram.com/paulhutchinsonofficial/

https://www.facebook.com/TheHutch2020/

http://www.linkedin.com/in/paulhutch

Welcome to Stripping Off with Matt Haycox

This isn’t your average business podcast. It’s where real entrepreneurs, celebs, and industry leaders strip back the polished PR, and get brutally honest about the journeys that made them.

Hosted by entrepreneur and investor Matt Haycox, Stripping Off dives into the raw, unfiltered realities behind success: the wins, the fuck-ups, the breakthroughs, and everything in between. No scripts. No sugar-coating. Just real talk from people who’ve lived it.

Whether you’re hustling to scale your business or just love a behind-the-scenes look at how people really make it, this podcast is your front-row seat to the truth behind the triumphs.

Who Is Matt Haycox? - Click for BADASS Trailer