Bloomberg Audio Studios, podcasts, radio news.

The world has waited for months for a lasting trade deal between China and the US, one that could potentially cool the tariff war that's been raging between both countries in President Trump's second term. On Monday, representatives from the US and China hold up in a mansion near Buckingham Palace in London to hammer that potential deal out, and on Tuesday they were still there. Brendon Murray runs Bloomberg's

trade coverage. He and other reporters have spent the last two days looking for any signs of how the talks might be going.

We've seen a lot of delivery food being brought to Lancaster House Otto Lingi both days, the upscale deli and dessert chain, but other than that, there's not much information coming out.

So lunch being brought in good sign, bad sign.

Well, yesterday's lunch was six bags was twelve, so we think maybe one side bought lunch for the other. But moments after that we saw the Chinese delegation leave for a lunch break, so apparently they weren't into it.

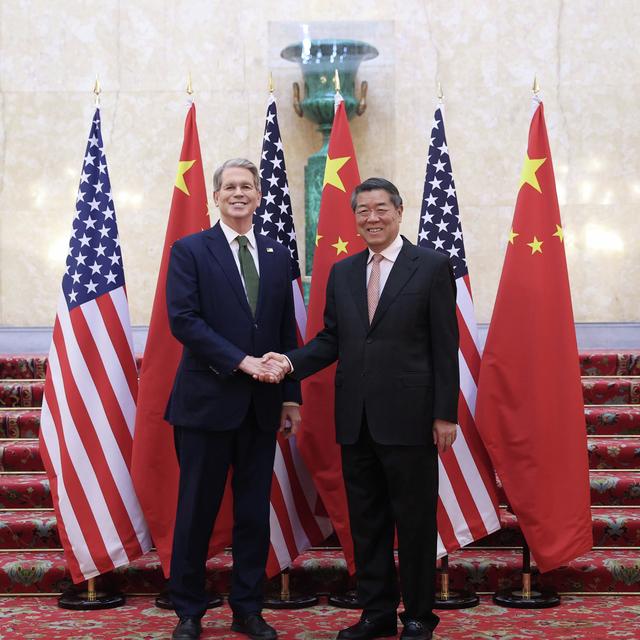

Around five point thirty pm local time, the two sides took a break, and a person familiar with the matter told Bloomberg they were planning to resume talks at eight pm Tuesday night. US Commerce Secretary Howard Lutnik said later that the talks went quote really, really well, and then while he hoped the negotiations would end this evening, they could stretch into Wednesday morning. And Bloomberg's John lu says there's still a lot at stake as both sides try to find common ground.

Can the United States accept a China that is three times as large economically and has the world's most cutting edge technology. Until that day comes, and it may never come, we will have trade wars.

I'm Sarah Holder, and this is the Big Take from Bloomberg News Today. On the show inside the latest trade negotiations between the US and China, I speak with Bloomberg Trade editor Brendan Murray, who's on the ground in London, and Big Take Asia host Juan ha sits down with John Lu who's been covering developments from Beijing. Could these talks mark a pivotal turning point in the tariff war between the US and China and what could relations between the two countries look like after they're done.

Well?

Brendan, You've been covering these negotiations closely over the past few months as tensions between the US and China have escalated and de escalated. When I spoke with you just last week, we talked about how the deal they'd reached in Geneva in May was on shaky ground, and how that, plus the lack of progress on other tariff deals more than halfway through the self imposed ninety day pause, had

put new pressure on Donald Trump's credibility at home. How has that ticking clock played into these talks this week in London.

Well, the focus for the past couple weeks for the Trump administration has really been on China. It's been almost exactly a month since they emerged from talks in Geneva, Switzerland with what they called a deal, which was essentially a ceasefire in the very high crippling tariffs that they

were imposing on each other. They brought those down to a significant degree, the US to thirty percent, China brought its tariffs down to ten percent, and they said, let's spend the next ninety days talking through these difficulties that we're having, reaching agreements on specific issues. But what's happened In the meantime, is China has shown the world how much leverage it has. China controls most of the world's

rare earth minerals. These are things that make electric car batteries and lasers and all sorts of advanced manufactured goods, and China controls most of the supply of them and the processing of them. And what's happened and is China has, either deliberately or through its bureaucratic process of permitting export licenses for those goods, has shown the world how much pain it can inflict on auto supply change aerospace supply

chains if it slows the export of those minerals. And the US recently has said, look, you're not complying with the agreement that we made in Geneva. We expected those permits and those rare earth minerals to start flowing to us sooner than that. Let's get back to the negotiating table. That's what led Donald Trump to urge Sijinping to get on the phone and say, we need to have a talk about this because this is going to hurt our economy. And it's not just the US. The European companies are

complaining about it. Indian automakers are also in trouble. If China withholds these very important critical minerals really could become a worldwide issue. The US, in the meantime started to make moves to put controls on things like software for chips, for jet engine parts, for nuclear reactor materials, some chemicals. So the US struck back and said, hey, we have stuff that you need too, and so China has an interest in seeing that stuff move to them too.

So how did they get back to the negotiating table. Who was more instrumental in getting these talks actually planned in London?

Well, Donald Trump has been urging Shijimpang to have a talk for months now. That urgency has increased recently in part because of the dragging of the feet that the US would say that China has done with the rare earth mineral those exports. And so the two leaders got on the phone and the team's got the go ahead to meet here in the UK. It's a bit of a neutral territory. They're at a venue right now that's not a US government site, not a Chinese government site.

It's neutral ground where they can hash out these differences.

Heading into these talks. The US's main priority was securing access to China's rare earth minerals, and China's goal was to get semiconductor chips from US tech companies like Nvidia. But those are big concessions, and Brendan says meeting in the middle was always going to be difficult.

The problem for the US and for China for that matter, is at what point do these products that are shipped around the world cross over into the realm of national security. At what point should the US say we shouldn't ship China our most sophisticated chips for AI because those could be used for supercomputing in defense applications and those sorts

of things, and vice versa. China would say we wouldn't want the US Defense Department to get a hold of our best critical minerals to be used in a military way. So the two countries are walking a very fine line between national security and economic security, and the line between those two is getting blurrier and blurrier by the day.

How are they trying to balance those concerns and what would a deal actually look like that would satisfy each party.

I think a deal that would allow both countries to maintain a certain amount of trade, but not so much trade that it impedes the other's ability to accomplish its domestic goal. President Trump wants to reshore manufacturing, and one way to do that is to put high tariffs on Chinese imports and to force some of that production back home.

China has an interest in exporting what it makes. It's still the factory of the world to the rest of the world, and if it's not to the US, it could be to other countries, to Vietnam or India or other places where those products would be welcome if they're not welcome in the US anymore. So, their two sides seem to be aiming for some sort of a re drawn arrangement where they can say, we'll trade with you,

but only up to a certain point. We'll make sure that we diversify where we're getting our imports from or exporting two and reduce the dependency on each other. Is ultimately what both sides want to do if what we are looking at is the battle for global economic supremacy over the next decade or two.

And then there is the last chess piece in these talks, the piece that Trump touted as a bargaining chip, on the campaign trail and enacted when he took office.

Tariffs Tariffs are something that you keep on until the very last moment of a trade negotiation. They are your leverage and you don't give them up at round one like we are now. So the tariffs that China bases for their products coming into the US are this twenty percent based on fentanyl and border security that initially Canada and Mexico also we're hit with, and the ten percent reciprocal rate that everyone else is dealing with as well, and China has brought its tariff of US products down

to ten percent. So there is a bit of a mismatch there, but it's a mismatch that both sides can live with for the time being.

The two sides haven't come to an agreement yet, formal or informal, but Brendan says once they do, both countries expect to see the results pretty quickly.

China would want to demonstrate that it's acting in good faith. The US said it wasn't after the Geneva agreement, so the US will want to see fairly quick action out of China, and China will want to see the US back off of its threats. Of its own export controls.

After the break, my Colleaguejan Ha sits down with Bloomberg's job Lou to talk about the factors that could be shaping China's thinking as the country's representatives sit at the negotiating table.

John, thanks so much for joining us.

Sure, it's wonderful to be here.

I really wanted to get your read of the mood on the ground in China right now. You know, the last time we took a temperature check, people were largely supportive of President she standing his ground in these negotiations.

Has that changed No, I think that remains the fact. There's a lot of support, a groundswell. I think I would even say that wants China to stand up and fight these tariffs. There is a broad view that the actions that the Trump administration have taken our prejudice. They're unfair, they're unjust. I think what's even added to it has

been these moves to void student visas. A lot of Chinese kids, a lot of Chinese families spent years working very hard saving money for the opportunity for that one person, one child, to be able to go to an Ivy League school and change the course of their lives and now they're being denied that possibility, and there is a lot of angst about that, and so there's a lot of support for she standing up to the Trump administration, but at the same time, I think there's also a

lot of worry. I think the fact that we've seen deflation CPI in China be negative for four months in a row, I think that speaks to how people are trying to save more, spend less, and that is a reflection of concern, not feeling a great deal of confidence about the future. Exports have been really important for the Chinese economy over the last couple of years because consumption. Domestic consumption has been so weak, and it's been weak

because of the collapse of property prices. Households are feeling poor, they're spending less, and so exports has really been the major driver of growth for China's economy over the last two or three years. That has come down substantially. Exports from China to the United States fell by thirty four point four percent in the month of May.

That's got to hurt.

That's the biggest drop since February of twenty twenty. So that's at the start of COVID now.

Before the talks were confirmed, Trump took to his Truth social platform last week to post that quote, she is very tough and extremely hard to make a deal with. He really wanted to get on that phone with President She, and it seemed to be a strategic decision for she. Was he holding out and what was the message that he was trying to send?

So I would start by saying, we don't know. But at the same time, I think there are some things about President Jipin deciding to get on the phone with President Trump that suggests one there could be more concern about the economy from the perspective of the Chinese leadership, and maybe that was the additional motivating factor for President She to do something that it was unorthodox, that was not something that Chinese leaders have done in the past.

They prefer for any deals to be struck, to be negotiated and the details worked out by lower level officials, and then President She would come in and sign a document put a ribbon on it. That is the preferred method of doing business. And so agreeing to the phone call suggests that something else is there. It could be

more concerned about the economy. It could also be that potentially the Chinese leadership saw some opportunity, some opening, some chance for she to get on the phone and maybe get a concession that the lower level officials would not have been able to get from the American side.

Certainly for the US, resuming exports of China's rare earth's mineral is really key in these talks, and turning the flow of these rare earth exports on and off seems to be a big leverage for China right now. Will we see China increasingly play hardball on that to get the trade deal it wants, certainly from the US, but also potentially from other global partners.

I think China is willing to play hardball, but I think there is an understanding in Beijing that the more you use the rare earth card, the more it actually gets other countries starting to think about, well, I can't depend on China for rare earths. I gotta have my own minds, I gotta have my own processing. And so the more that Beijing uses it, potentially the less powerful

it becomes. Although the caveat there is you don't build rare earth refineries and rare earth minds overnight, so it's going to be a period of time.

On the other side, China is hoping that the US doesn't play hardball when it comes to semiconductor chips. But if the US is willing to compromise there and ease restrictions on semiconductor exports, John says, it could open the door to other deals.

If the Trump administration is going to show that it's willing to negotiate on these sanctions, it brings up the possibility that the Trump administration might, I'd also be willing for the right price to negotiate the other sanctions that were put in place by the Biden administration, sanctions that are more targeted at more fundamental technologies, and so that I think is another important aspect of what happens next.

Now, you mentioned at the top that these tensions we're seeing right now between the US and China, they're not only about trade. We've also seen the Trump administration revoke Chinese student visas and looking at limiting intrigue to the US for Chinese students in critical math, science and tech fields. How is all of that contributing to the tone around these negotiations.

So the Chinese leadership is not elected, there are no elections but at the same time, the Chinese leadership is very sensitive to public opinion. It's maybe even more so sensitive because there are no elections, right, they have to keep track of how people are feeling. And so when you have student visas being canceled and parents being upset and that affects entire family, that's something that strikes accord

with the Chinese government. There is another issue, I think, which is Taiwan, and that is the number one issue when it comes to the US China relationship if you ask anybody in Beijing. And before these most recent talks, there was a report by Reuters that the Trump administration

was planning a very large weapons sale to Taiwan. We don't know if that came up during these talks, but one thing that Beijing would be very eager for is some displayed by the American side of adhering to the One China principle, not supporting Taiwanese independence, not supporting the current Taiwan administration, which the Chinese side views as being extremely pro independence and hostile.

What do we think China wants beyond the tariff negotiations that are happening this week, What more does China want out of this.

I think fundamentally what China wants is space to maneuver economically and diplomatic the world. Right now, on a per capita basis, the average Chinese citizen is making only about a third or a quarter as much as the average American person is, so China is still relatively poor. The goal of the Chinese government of Xijipin is to move China from middle income to high income, and to do that, they need technology and they need trade, and so that's

what they want. They want to have a world in which China has access to technology that can fuel its economic growth, that can move its standard of living up. And they want access to markets so that the goods that Chinese companies produce have a place that they can be sold into.

This is the Big Take from Bloomberg News. I'm Sarah Holder. To get more from The Big Take and unlimited access to all of Bloomberg dot Com, subscribe today at Bloomberg dot com slash podcast offer. If you liked this episode, make sure to follow and review The Big Take wherever you listen to podcasts. It helps people find the show. Thanks for listening. We'll be back tomorrow.