DIY Delaware C-Corp taxes for a new startup with no funding, no payroll and no assets

How we filed corporate taxes in Delaware, Florida and Canada with a minimal budget.

Table of Contents

TL;DR

Last year, we paid $1,800 to a tax professional to file our taxes. This year, we did everything ourselves for $245.

Context

We're a tiny bootstrapped startup that needs to file taxes for the 2024 tax year.

- Delaware C-Corp with two co-founders (US and Canada) and one employee in 2024.

- No external funding, no assets, and no payroll. Founders contributed cash to cover the business costs.

- Less than $1,000 in revenue (product launched at the end of the year).

- Just over $6,000 in costs – mostly cloud infrastructure, tools and oh well... tax filing costs and fees!

Naturally, we don't owe any tax to the government. Yet, the filing burden is still pretty significant, because as far as the US government is concerned, nothing is simple.

Disclaimer: None of this is financial, tax, or legal advice. We're sharing our own experience for educational purposes only. Use your own judgement or consult a professional when following in our footsteps.

What do we have to file?

As a Delaware C-Corp, it is mandatory for us to file and pay fees for:

- Corporate Annual Report and Franchise Tax in Delaware – in layman terms, this is the annual report and the fee you have to pay for the privilege of being incorporated in Delaware and enjoy the liability protection. It's due on March 1st each year.

- U.S. Corporation Income Tax Return (Form 1120) – it's like personal income tax, but for corporations. It's due on April 15th each year.

- Beneficial Ownership Information (BOI) – while this is not a tax per se, you have to file the report that shows your corporation's ownership structure. It's a new requirement that has been cancelled and reinstated a few times. The current year's deadline for is March 21, 2025.

Due to our setup, we have additional reporting burdens. Yours might be different depending on your legal entities, but here are ours:

- Annual report in the state of Florida – because our primary presence is in Florida, we have to file an annual report here.

- Tax filing in Canada – because one of our co-founders is a Canadian who owns his shares via a holding company in Canada, he also has to file corporate taxes in Canada.

Related post: How much does it cost to be a business?

How we did our taxes the first time

In early 2024, everything was new and daunting. Instead of trying to figure out taxes, we decided to hire a professional.

- We used Fondo to file our Delaware Franchise Tax and BOI. In addition to the government fees, we paid $1 to file in Delaware and $200 to file BOI.

- We used a local tax specialist to file our corporate tax and the Florida annual report. We paid $1,800 for the CPA services.

- We paid $15/month for a few months for a QuickBooks subscription to create the Balance Sheet and Profit & Loss (P&L) statements.

Overall, we paid over $2k for tax filing services.

How we are doing tax filing for 2024

This year, we filed corporate taxes ourselves.

We paid $245 for TurboTax Business Desktop software for the federal ($190) and state ($55) tax returns + all the government fees.

Delaware Franchise Tax and Corporate Annual Report

When we first started looking at the Delaware Franchise Tax, we got confused by the verbiage.

The minimum tax is currently $175.00, using the Authorized Shares Method and the Minimum Tax using the Assumed Par Value Capital Method is $400.00 with a maximum tax of $200,000.00 for both methods[...]

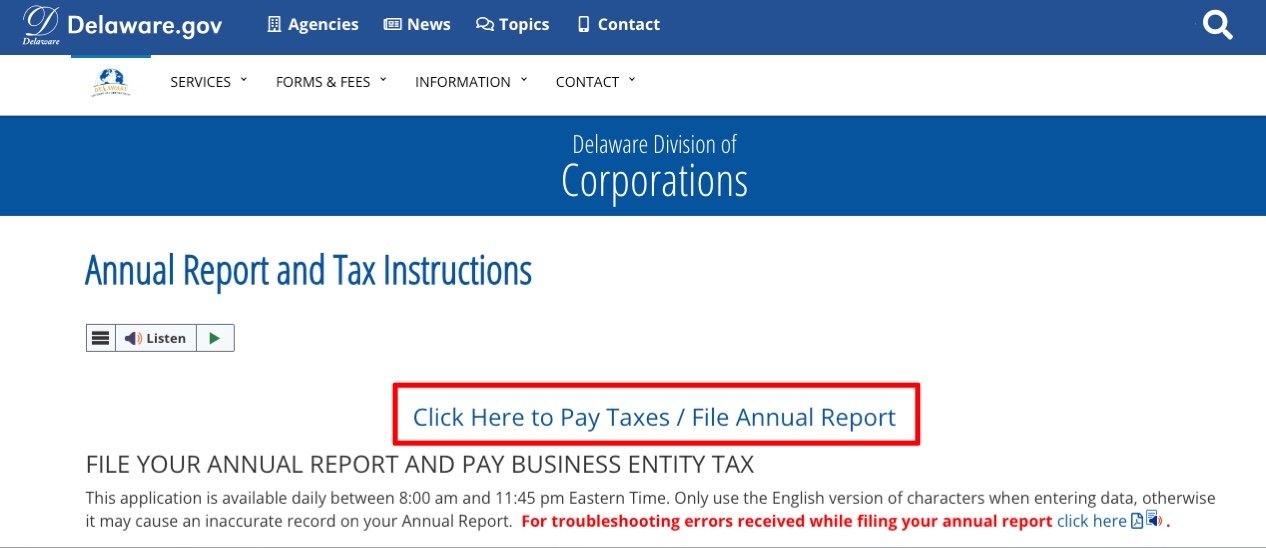

Annual Report and Tax Instructions

If you're up for it, ChatGPT is very good at explaining what those methods mean and show you the formulas.

This is the gist:

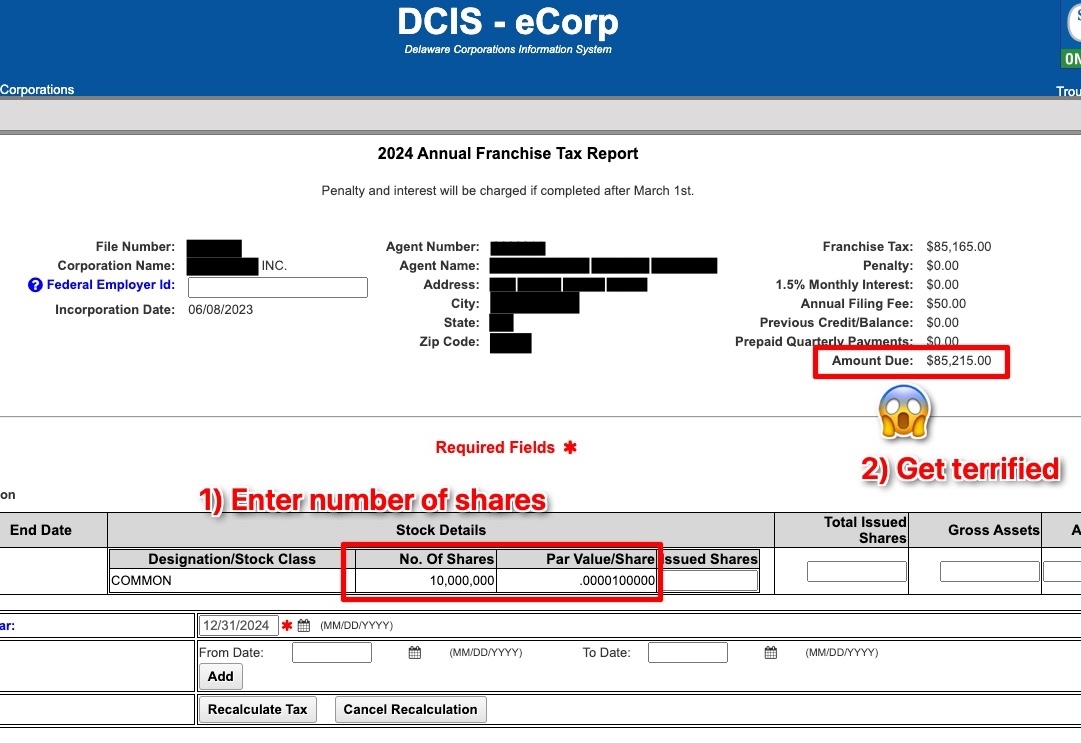

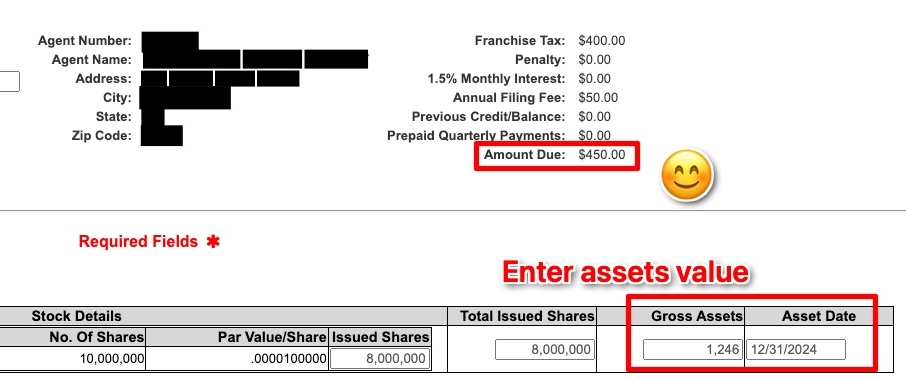

- If you use the Authorized Shares Method, the fee will be calculated based on how many shares you issued. If you used Clerky, Stripe Atlas, or similar services to incorporate, you'll probably have 10M common shares. This method will make your fee enormous. Ours was $85k. This method is a non-starter for a tiny startup.

- If you use the Assumed Par Value Capital Method, the fee will be calculated based on your assets. If you don't own anything tangible, your assets will be the cash in the bank at the end of the year. If you haven't raised or made a ton of money, you'll end up paying the minimal fee of $400.

Worry not! The government form is smart enough to choose the optimal method for you automatically. Most new startups with low assets will only pay $450, of which $400 is the minimal franchise tax calculated with the Assumed Par Value Capital method and $50 is the filing fee.

If you see a larger number, you'll probably want to consult a professional.

How to file Delaware Franchise Tax DIY

- Go to the Annual Report and Tax Instructions page and choose "Click Here to Pay Taxes / File Annual Report."

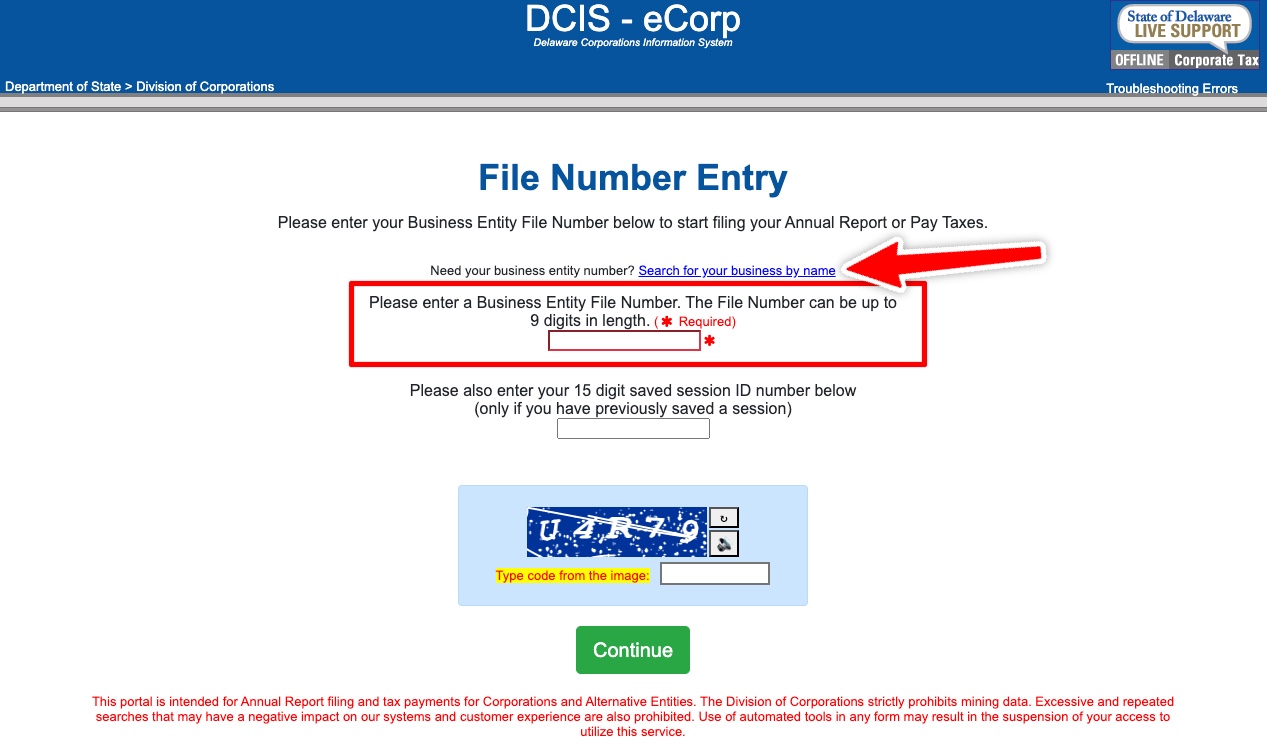

- Look up your company's "Entity File Number" using the "search" link and paste it in the form.

- [The scariest step] Enter your number of shares and the see the huge Amount Due that will make your stomach churn.

- Now enter your assets value (the beginning balance of your bank account on January 1, 2025), click "Recalculate Tax" and see the final number. If your assets are low, you'll need to pay the minimal tax.

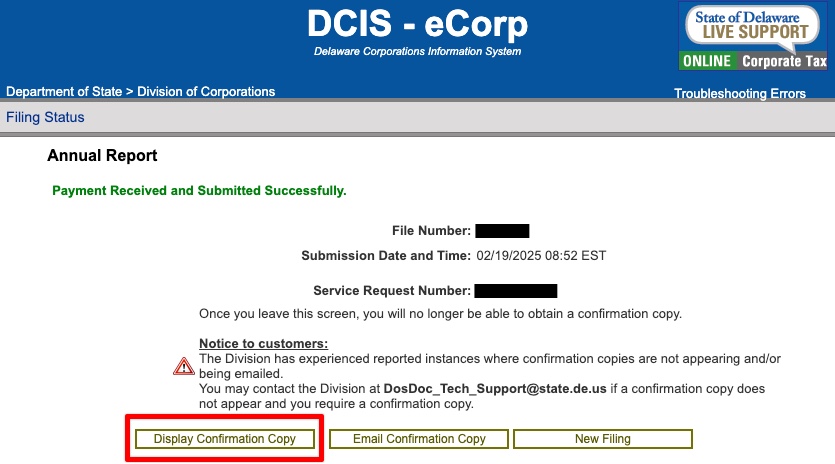

- Complete the form, pay and save the confirmation copy. We only received an email with the confirmation of payment, not with the PDF. To be safe, download the confirmation copy PDF right there and then.

Federal Corporate Income Tax (Form-1120)

You are required to file the federal corporate income tax (Form-1120) by April 15th each year.

We opted to use TurboTax this filing season. The problem was that C-Corp taxes can only be filed in the TurboTax Business Desktop downloadable product. And... it's only available for Windows while me, my co-founder and our family members only have Macs.

The software costs $190 (in 2025) and allows you to make up to 5 federal corporate tax filings.

How to use TurboTax Business Desktop on a Mac with AWS Workspaces

We researched a few options of running Windows software on a Mac. Parallels seemed like an attractive option, but it felt too expensive — $99/year + the Windows license.

We chose to use AWS Workspaces to run Windows on a virtual desktop. A workspace with 4Gb memory (important: Turbo Tax won't run on a cheaper 2Gb machine!) is $7.25/month + $0.30/hour if you choose a workspace with a Windows license. It is reasonable, because you can do all your returns in a few hours and shut down the workspace.

If you don't have an AWS account, you'll need to create one on the AWS website, enter your credit card, etc. Then navigate to Workspaces and follow the quickstart guide to create a Windows workspace. It'll guide you through all the steps, like setting up a directly.

These are the parameters we used:

- Launch bundle — Standard with Windows 10 (Server 2022 based) (WSP)

- Operating system — Windows Server 2022

- Protocol — DCV (this is important if you want to use the web client)

- AutoStop Time — 1 hour

- Compute — Standard (this comes with 4Gb of RAM)

The process is complicated, because the product is optimized for an enterprise IT admin, not for an indie developer trying to save on tax filing. But hey, we're saving over a thousand bucks here, so might as well endure some pain.

After you've configured the workspace, it'll take some time (30 mins or so) to start up. After the status changes to "Available," connect to it using one the clients. Use the provided registration code, user name, and password you created during the quickstart.

Then, download TurboTax Business Desktop (inside the workspace), install it, and you're all set.

Note: The process of sending and printing files from the workspace is complicated, because there's no direct way to transfer files between your computer and the workspace. I simply logged into my Gmail and emailed files to myself. You can also login into your Google Drive or Dropbox on the web to transfer files.

After you're done with all the taxes, delete the workspace, so you stop incurring charges. Then, deregister and delete the Simple Directory that was created for you.

Don't forget to save all the files in your own email or cloud drive before you delete the workspace!

File Form 1120 with TurboTax Desktop Business

Next, you open TurboTax and start the return.

It's a tedious data entry process that took us about an hour, maybe a little more. When we were in doubt, we referred to last year's return prepared by a CPA and mimicked the calculations. We also made extensive use of ChatGPT to understand some of the terms.

Note: Never let ChatGPT do the math for you! Use ChatGPT to explain concepts, but always do your own math.

As you go through the process and fill in the forms, you'll eventually be able to e-file Form-1120 with IRS.

TurboTax will also check if your state requires you to file a report and will do the forms for you for an additional $55 per state.

We had to file FL-1120, because we are operating out of Florida. Surprisingly, the state of Florida doesn't support e-filing, so we had to download the form, email it to ourselves, print, sign, and send it with USPS to Tallahassee.

Florida Annual Report

This may not apply to you if you're in a different state. Check with your state if you are required to file an annual report like we are in Florida.

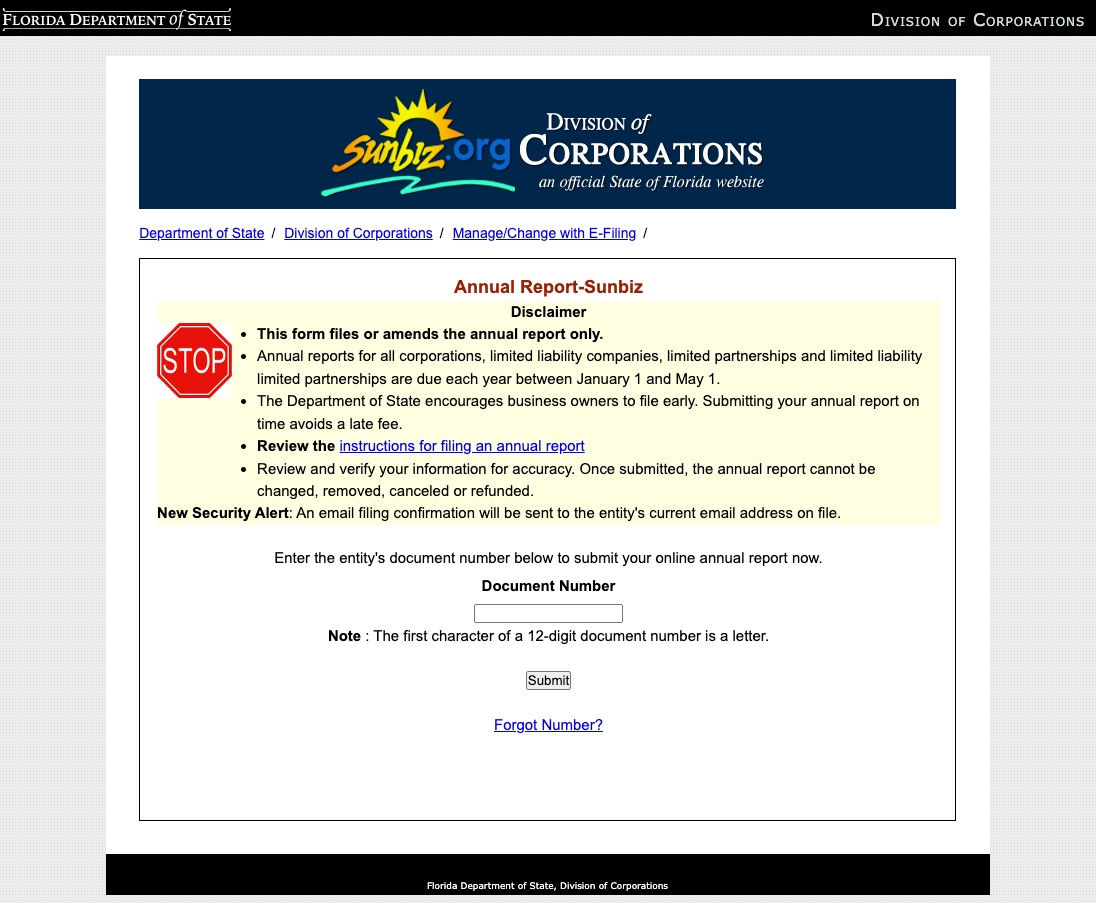

Go to Sunbiz, fill in the form, and pay $150. It's that simple.

Conclusion

If you're tiny and don't have payroll, you can file your taxes for cheap.

However, if you don't know what you're doing, we recommend consulting a tax prep specialist. Saving a couple thousand dollars may not be worth it if you get in trouble with the IRS.